December 1, 2023

While the exact numbers are uncertain and debatable, there is no question that the Islamic Republic is exporting more crude than in recent years and is making more money because of it.

While the exact numbers are uncertain and debatable, there is no question that the Islamic Republic is exporting more crude than in recent years and is making more money because of it.

The regime likes to claim it’s pumping oil like in the good ol’ days before sanctions. In fact, it regularly claims that it has broken the back of sanctions and has devised numerous effective ways to get around them. But then the next day it complains that sanctions are harming the Iranian people, causing unemployment, preventing the import of technology and causing people to die because sanctions stop the import of medicines, although the regime just recently said it makes 99 percent of all the medicines used in Iran and now can export many medicines.

As for crude oil exports, Republicans in the US are slamming Joe Biden for thinking the mullahs who run Iran are nice guys who can be brought around to rationality with a little bit of kindness, such as not enforcing sanctions. Even Democrats are complaining that Biden isn’t doing enough to enforce sanctions and are prodding him to do more.

So, what’s going on?

The first thing to note is that Iran isn’t selling oil to a whole bunch of countries. More than 90 percent of Iran’s oil exports probably much, much more than 90 percent of the barrels it sells are going to China. Biden is unable to stop that flow. But remember that Donald Trump was not able to stop the crude flow to China either.

Recently, a Treasury Department official told reporters that Iran is selling oil today to the same buyers that were evading sanctions under Trump. He said there are no new buyers of Iranian oil.

Almost all the crude that got out of Iran under Trump went to China.

And almost all the crude that has gotten out of Iran under Biden has also gone to China.

The difference is that China is now buying much more oil. But it’s not the big Chinese firms Sinopec and CNOOC that are buying Iran’s oil now. It’s tiny refineries scattered all over China that are slurping up Iran’s crude.

And it’s not clear that Biden (or Donald Trump) can actually do much to stop China’s purchases.

“The trade is very sophisticated, with multiple middlemen, which makes it a lot more difficult for the US to sanction. The US can hit companies that are more public or obvious in their Iranian dealings, but many of these middlemen are small entities,” Homayoun Falakshahi, senior oil analyst at data and analytics group Kpler, told Bloomberg News.

“It’s hard to know who to go after. The US can sanction teapot refiners [the slang term for small refiners in China] and even national oil companies like Sinopec, but that would create more of a political issue amid already tense relations.”

Traders say these sanctions will not derail crude trades as other players including hundreds of tankers in the so-called “dark fleet” remain in business, illustrating the limits of Washington’s reach.

Sanctions on firms in Singapore and Malaysia earlier this year for their roles in allegedly facilitating the sale and shipment of millions of dollars’ worth of petroleum and petrochemicals on behalf of a company with known connections to Iran did little to dent trade with the ultimate destination, China which only rose.

“The trade with China is probably something the US would struggle to entirely shut down,” Raffaello Pantucci, a senior fellow at the S. Rajaratnam School of International Studies in Singapore, told Bloomberg. “They could put more pressure on Chinese companies if they focus investigations, determine links and extend the range of sanctions. But they’ve extended quite a few sanctions to various Chinese entities already.”

Beijing has long used smaller financial institutions like Bank of Kunlun a key Chinese conduit for transactions with Iran to facilitate this commerce and limit the exposure of larger entities with international business links. Sanctions work by denying access to the US dollar. But Bank of Kunlun doesn’t do business with the dollar. That limits what sanctions can do. And it also gives the bank a niche it can exploit.

More recently, Chinese importers have benefited from the development of a yuan-based alternative to Western clearinghouses a platform known as CIPS, Cross-border Interbank Payments System, launched by the Central Bank of China to settle international claims.

On the logistical front, there is the expansion of the dark fleet of vessels carrying oil from sanctioned regimes (Russia as well as Iran) to global customers, leaving buyers like China with options. Today, including Russian tankers and those willing to load Urals and other grades, it has expanded to about 600 ships.

“If you find a middleman and decide to go harsh, they’ll go out of business. But many of these firms are shell companies with fake offices,” said Kpler’s Falakshahi. “The same people can easily set up another new company in one or two months. The impact will be temporary.”

Almost all the Iranian oil entering China today is branded as originating in Malaysia or some other country. It’s often loaded at Kharg Island and then transferred at sea to another tanker that is half full with Malaysian crude and sails on to China with papers saying it is carrying Malaysian crude.

Except for two cargoes one in December 2021 and the other in January 2022—Chinese customs has not recorded any Iranian oil imports in three years, since December 2020.

Giant state refiners Sinopec and PetroChina were once key Iranian oil clients, with investments in Iranian oilfields. But they stopped lifting Iranian oil in late 2019, when Trump re-imposed sanctions on Iran.

The sanctions initially led to a sharp drop in flows to China, but volumes soon rebounded as more independent refiners joined the purchases.

Most of the more than 40 independent Chinese refiners, known as teapots, process Iranian oil, according to Chinese traders. Teapots have little exposure to the dollar-based global financial system and don’t need to cooperate with western firms on technology. Most of the transactions are believed to be paid in Chinese currency. Thus, sanctions geared to the US dollar have no effect.

And these buyers will keep buying because Iranian oil is so cheap, expressly because of the sanctions. Iranian Light, the main export grade, trades at a discount of about $13 a barrel right now. That compares with a premium of about $5 a barrel for similar-quality Oman crude. So, the teapots are saving about $18 off a barrel that now sells for $80 to $90 a barrel on the spot market—in other words, a savings of about 20 percent.

Iran International says the added costs of dealing with under-the-radar intermediaries and tanker firms that operate off the books adds immensely to Iran’s selling costs and reduces its revenue by more than half to around $40 a barrel. On top of that, Iran International says many Chinese teapots do not pay in cash, but in barter goods, which makes any calculations much harder.

But GOP lawmakers in Washington continue to say falsely that China is buying more Iranian oil because the Biden Administration has decided to ease enforcement of sanctions to try to gain goodwill with Iran. The Wall Street Journal said in a November 11 editorial, “As part of Mr. Biden’s quiet diplomacy with Iran, the US has curtailed sanctions enforcement.”

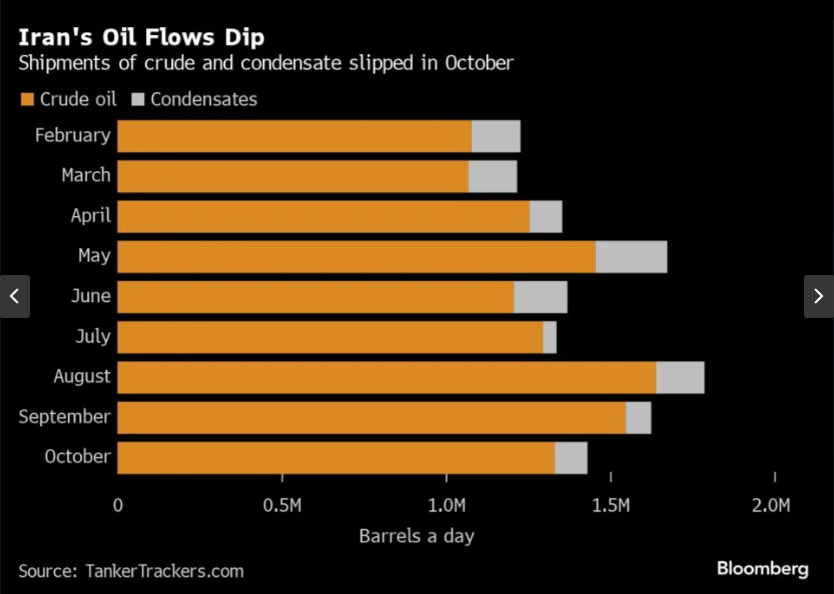

Many people think the Islamic Republic is now rolling in cash and using it to underwrite Hamas, the Palestinian Islamic Jihad, Hezbollah, the Houthis and assorted militias in Iraq and Syria. But Iran is not rolling in cash. Davoud Manzour, head of Iran’s Planning and Budget Office, said in October that’s Iran’s revenues for the first seven months of the current Persian year ran at only 70 percent of what was needed to cover budget expenditures. He said a balanced budget required Iran to sell 1.5 million barrels a day of crude and condensate, which it is not doing, at an average price of $85 a barrel, which it is nowhere near achieving.

Manzour also said oil exports are less than 1.5 million barrels a day, though he did not give a number. But he did not blame that on an inability to sell, but rather on domestic demand, especially during the summer months when the demand for gasoline soars.

(Manzour said there were other problems limiting revenues. For example, the privatization program is supposed to net 1 quadrillion rials ($2 billion) this year but yielded a mere $200 million in the first seven months of the Persian year.)

Another pressure point comes from the other side of the world. In August, the United States pumped 13.1 million barrels a day the highest output ever in American history.

The US government grants that Iranian output has grown in 2023. Here are the quarterly production figures, in millions of barrels per day, for crude oil (not including condensates) published by the Energy Information Administration (EIA), an agency of the US Department of Energy.

1q22 2.55

2q22 2.53

3q22 2.53

4q22 2.56

1q23 2.60

2q23 2.74

3q23 2.93

Note that this is production, not exports. It includes all the fuel needed by the domestic market, which is growing day-by-day. But it also does not include condensates. Condensates are used for the same purposes as crude oil. But decades ago, they were unimportant so OPEC and many others just dropped them from the charts.