September 06, 2019

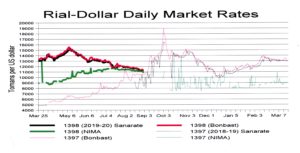

To the surprise of many and the joy of the regime, the rial continues to improve versus the dollar, with the average daily price as calculated by different websites running between 110,000 and 116,000 since August 24.

To the surprise of many and the joy of the regime, the rial continues to improve versus the dollar, with the average daily price as calculated by different websites running between 110,000 and 116,000 since August 24.

Tehran’s Financial Tribune said this did not reflect growing faith in the rial, but rather lack of demand for foreign currency in general. It said the government appears to have driven away “the avaricious activities of middlemen and speculators in jacking up prices.”

Government officials boasted of the stronger rial and naturally attributed its improvement to actions of the Islamic Republic.

Some agreed. Kamran Soltanizadeh, chief of the Association of Foreign Exchange Bureaus, said, “There is no more ‘fake demand’ for currency in the market, thanks to Central Bank management and the cooperation of the money changers.”

Like many others, he said the previous spikes and hikes were heavily influenced by false stories running on social media sites that prompted people to rush to the open market.

This improvement has come despite the fact that the Central Bank has not yet launched its new foreign exchange market plan. That was supposed to have been in place early in August, but is nowhere in sight and the Central Bank says more work is required.

The Iran Times monitors four different websites that give the average trading figures for the rial each day. They never come up with the same figure. Since August 24, the daily average as posted by Sanarate, the site maintained by the Central Bank, and claiming to include all foreign currency transactions on the open market, not just a sampling, has ranged from 115,752 to 110,301, with the trend to the lower figure. The daily averages cited by the other three websites—Mesghal, 2gheroon and Bonbast—have all been within that range.

The dollar price on the NIMA exchange, the bourse where importers can buy foreign exchange from exporters, has strengthened dramatically and the price of the dollar is almost the same as on the open market. In fact, on three recent selling days, the average on NIMA has been marginally higher than the open market calculation by Sanarate.

Of course, the rial remains just a shadow of its former self. According to Sanarate, the price on September 1 this year was 111,760, while on the same day last year it was 109,497 and on the same day two years ago it was 46,405.