December 25 2020

OPEC has voted to increase its output by just one-half of 1 percent in January, a compromise between those who advocated a 2 percent hike and those who opposed any increase whatsoever.

OPEC has voted to increase its output by just one-half of 1 percent in January, a compromise between those who advocated a 2 percent hike and those who opposed any increase whatsoever.

Because Iran is under sanctions and producing very little oil, it has been exempt from OPEC quotas. Venezuela and Libya, whose output is irregular, have also been exempt this past year, but Libyan output recently began to surge as fighting there declined.

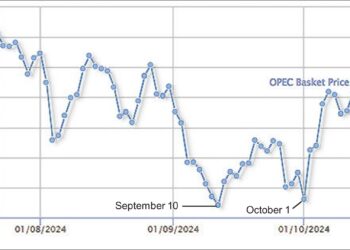

Global output was just shy of 100 million barrels a day a year when prices plummeted because the coronavirus had made oil consumption drop precipitously and prices fall equally precipitously. Prices fell from $50 a barrel on the last day of February to a low of $12.22 on April 22. Prices have been climbing back recently, but only reached $50 again on December 16.

In April, the 13 members of OPEC and another 10 producers led by Russia and known as OPEC+ agreed collectively to cut their production by 9.7 million barrels a day. They restored 2 million barrels of that in August and planned to restore another 2 million in January.

But Saudi Arabia wanted to keep production level and not restore any more of the cuts, while Russia wanted to restore the full 2 million of the original cut.

After considerable bargaining behind closed doors, the decision was made to restore 500,000 barrels in January and another 1.5 million over succeeding months before July 2021.

Mugsit Ashraf, an analyst at the consulting firm Accenture, said OPEC faced something of a Catch-22 situation. Lifting production could cause a price drop. But keeping the cuts in place could prop up prices to the benefit of non-OPEC and OPEC+ rivals—like the United States, whose frackers would rack up sales.

Another problem was member states who had ignored the cuts and overproduced, like Iraq.

The result was a classic compromise.

The remaining question is what impact the new deal will have on prices. Iranian Oil Minister Bijan Namdar-Zanganeh said, “I do not think the decision will have an influential impact on the market in terms of decreasing prices as producing 500,000 more barrels is not a big amount.”