September 06-13

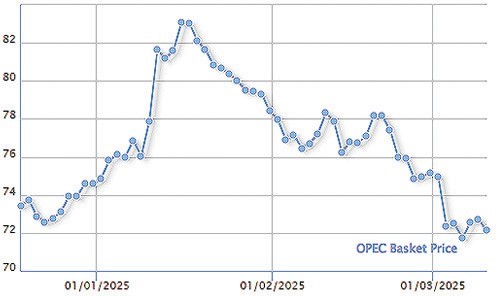

The Islamic Republic is only getting a quarter of the income it would be getting from oil if not for sanctions, US officials said last week.

That is far worse than previously thought. The problem for Iran isn’t just reduced oil sales but its inability to get its hands on much of money paid for the oil it is selling.

Iran’s oil sales have been cut by 55 percent as a result of sanctions. But the US has concluded that nearly half of Iran’s earnings from its remaining oil exports are accumulating in accounts overseas because of banking restrictions that limit Tehran’s access to the money.

The estimates, provided to The Associated Press by a senior US official and never released before, are the latest indication that sanctions are deepening Iran’s economic distress and making it increasingly difficult to access billions of dollars in vital oil revenues.

Based on current prices, the Islamic Republic would be earning $7.6 billion a month from crude oil sales if its sales volume was at 2.5 million barrels a day—the level that prevailed for two decades until 2011.

Sales so far this year, however, have average only 1.1 million barrels a day. Revenues from those sales have averaged $3.4 billion monthly during the first half of 2013, according to the assessment.

But the US estimates that $1.5 billion in crude oil revenues is piling up in restricted foreign accounts every month. Iran is actually getting its hands on only $1.9 billion a month. That means Iran is not able to spend or repatriate about 44 percent of its crude oil income, the AP reported.

More importantly, it means Iran’s oil receipts are only 25 percent of what they would have been if not for sanctions. That is a much deeper cut than anything the Iran Times has reported before.

The February sanctions, which dealt one of the harshest blows to the Iranian economy in recent times, aimed at cutting off access to oil revenues. The sanctions require an already reduced pool of oil importers to pay into locked bank accounts that Iran may access only to purchase non-sanctioned goods in that country or humanitarian supplies.

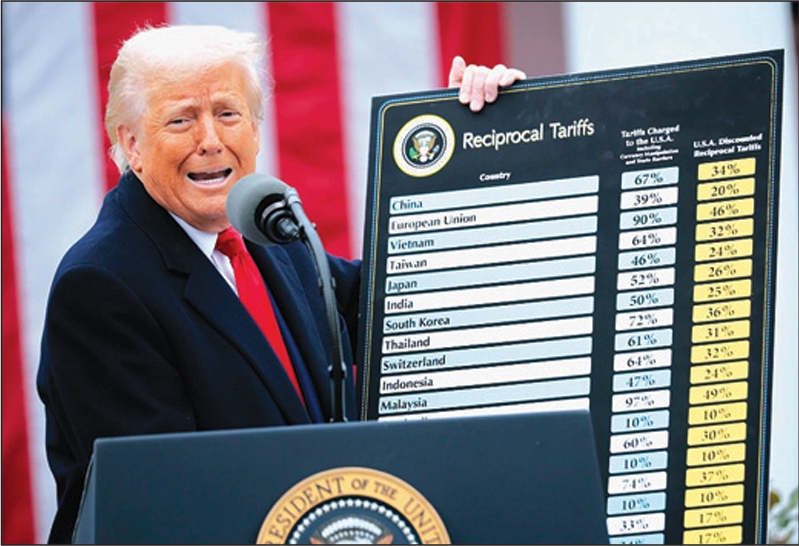

If importers do not comply, they face the threat of being shut out of the US financial system. The US has granted sanctions exemptions, however, to the six countries that continue to buy most of Iran’s oil—Japan, South Korea, China, Taiwan, India and Turkey.

The US reached the estimates by looking at Iran’s trade imbalances with oil importers based on customs data from each of the relevant countries. The figures show Iran cannot spend the full amount it earns because it is limited to buying only non-sanctioned goods for imports from the small pool of trading partners. And it is not able to repatriate the money to fill its foreign reserve coffers or cover any budget shortfalls, the AP reported.

Garbis Iradian of the Institute of International Finance (IIF), an economic think tank, told the AP that despite wave after wave of sanctions, Iran continues to run a trade surplus. But that surplus has been shrinking steadily since 2011. The assets piling up abroad could render most of that remaining surplus essentially unusable.

“This is a major development,” Iradian said. “If they don’t have access to this, it is an additional burden, and if that continues on they will feel the pain. It seems the sanctions intensified with this accessibility issue.”

Iradian, the deputy director of the IIF’s Africa and Middle East Department, said Iran’s total trade surplus has fallen from about $70 billion in 2011 to about $44 billion in 2012. The IIF estimates it will reach about $38 billion by the end of this year. And with $1.5 billion a month accumulating in restricted accounts, some $15 billion of the $38 billion surplus may be out of reach.

“This brings down their trade surplus to almost zero,” said Iradian. “That is quite severe…. They are entering a dangerous zone.”