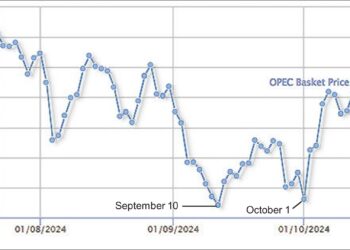

The open market rial rate and the Tehran Stock Exchange (TSE) index do not signal any marked improvement as a result of the tentative nuclear agreement reached April 2, although many commentators in Tehran are trying to claim a boom has begun.

As shown in the three-month chart above, the stock market index has risen recently. But the low point on that chart was March 17, so the rise began well before the nuclear agreement was reached. What’s more, since April 4, the TSE index has dipped again, hardly a sign of business confidence as a result of the tentative agreement.

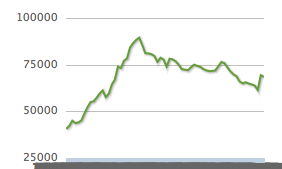

Furthermore, as the chart below shows, when you take a longer, two-year, view of the TSE, the market remains far below its highpoint in January 2014. In fact it is still more than 20 percent below its record. And when factoring in inflation since then, it is actually more like 40 percent below its high.

The rial chart in the box below shows the rial has only improved marginally in recent weeks. And that improvement also began in mid-March, well before the tentative agreement. The agreement hasn’t had any measurable impact. The day before the agreement was announced, the dollar went for 33,300 rials. As of Tuesday, the market rate was 33,460, an insignificant difference.

For the rial to improve to a point where it is worth discussing, the price of the dollar will really have to fall below 30,000 rials, where, as the chart shows, the rial sold for the first several months of President’s Rohani’s term. In April 2014 it slipped in value and in December 2014 it slipped again.

The improvement of the past month has actually only taken the rial back where it was before last December, an improvement but still about 10 percent below the level that prevailed in the first several months/s of Rohani’s tenure.

In sum, there is no sign that the tentative nuclear agreement has had any impact worth talking about on Iran’s currency and stock market.