September 03 2021

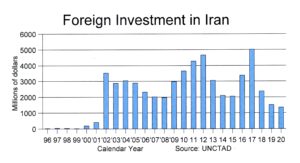

Foreign investment flowing into Iran plummeted to the lowest figure since the Islamic Republic decided to try to attract foreign investment at the start of the 21st Century.

Foreign investment flowing into Iran plummeted to the lowest figure since the Islamic Republic decided to try to attract foreign investment at the start of the 21st Century.

That’s according to the annual report on Foreign Direct Investment (FDI) by UNCTAD, the UN Conference on Trade and Development, released June 27. And the UN figures totally contradicted the figures issued three weeks earlier by Iran—as they do every year.

The Islamic Republic claimed June 7 that FDI flowing into Iran soared 189 percent in the Persian year ending at Now Ruz. UNCTAD said the FDI flow into Iran fell 11 percent in 2020.

Actually, the decline was in many ways nothing to cry over. Globally, FDI flows plummeted by one-third, largely because of the coronavirus epidemic. So, an 11 percent drop in Iran beat the average markedly.

On the other hand, FDI flow had already plummeted previously because of US sanctions. As the chart shows, in 2017, the last full year before the Trump Administration re-imposed sanctions, FDI surpassed $5 billion, so the decline since then has been a massive 73 percent.

The unanswerable question is whether Iran will once more become a desirable location for investment if sanctions are lifted. The Islamic Republic has developed a less than enviable reputation for a state in which to do business. A key reason is Iran’s refusal to date to accept the banking standards of the Financial Action Task Force (FATF), which has resulted in it being placed on FATF’s blacklist with only one other country, North Korea.