September 3, 2021

New Economics Minister Ehsan Khanduzi says his top priority is to boost tax revenues and see the tax-to GDP ratio rise over the next four years from the current 4 percent to around 6 percent.

That would still leave Iran with a rather low tax-to-GDP ratio as it was 6.6 percent as recently as 2018, according to state broadcasting

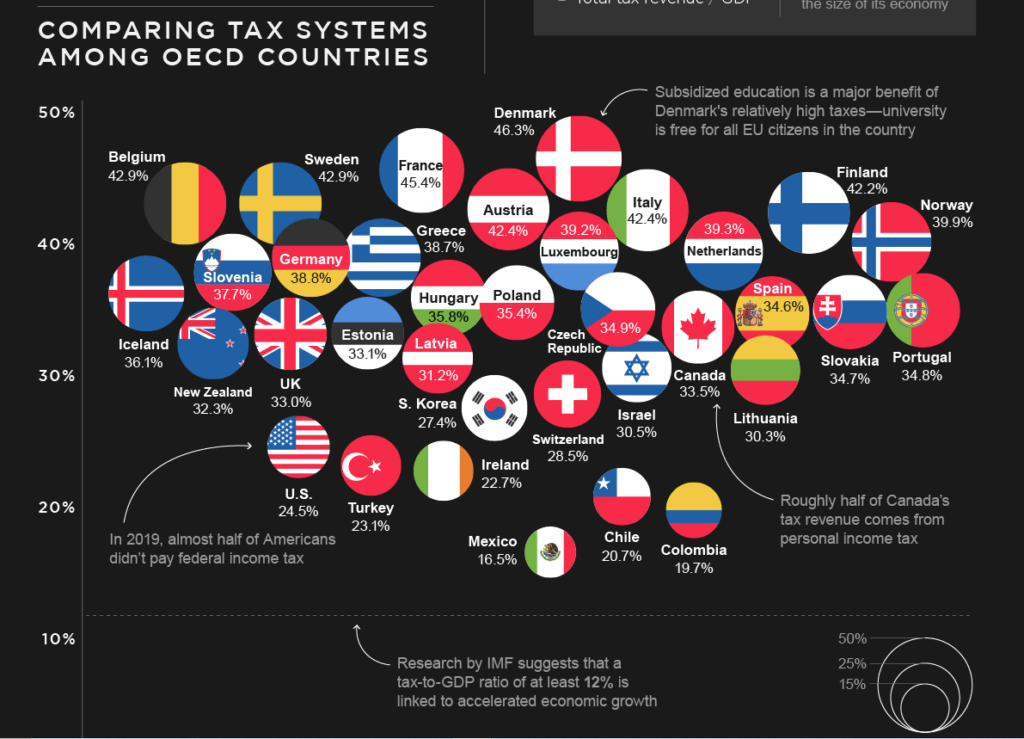

What’s more, it would leave Iran with a tax-to-GDP ratio far lower than any member of the Organization for Economic Cooperation and Development (OECD), a grouping of 38 major market economy or capitalist states.

The average tax-to-GDP ratio of the OECD states is 33.8 percent, with Denmark the highest at 46.3 percent and the United States among the low ratio states at 24.5 percent.

Iran has historically relied most heavily on oil revenues rather than taxes for its government operating revenues.

But it also has a problem with tax avoidance as few citizens pay the legal tax rates, except for salaried workers who have taxes withheld by their employers.