December 06-2013

The United States produced more crude oil in October than it imported for the first time since early 1995, as domestic shale oil output continued to surge and US consumption of petroleum products remained relatively flat, the US Energy Information Administration said last week

The booming oil production in the United States—and elsewhere—is one more worry for Iran. Many analysts speculate that when sanctions are removed and Iran begins pumping oil again, prices may plunge. But one thing Iran has going for it is that the shale oil behind the US boom is expensive to produce. If oil prices fall too far, shale oil production sites will be shut down, driving prices back up.

The new US output figures mark a milestone in the rebound of US oil production since drillers started using a combination of horizontal drilling and hydraulic fracturing to unlock oil previously trapped in layers of shale rock in states such as North Dakota and Texas. At the same time, gains in automobile fuel efficiency and other areas have been curbing US oil consumption.

The trend is expected to continue for another decade as US domestic oil supplies grow and reliance on imports shrinks, easing one of the main sources of pressure on global oil markets.

For now, however, the United States remains the world’s biggest oil-consuming nation and the largest importer of crude oil. (China is the world’s biggest importer of crude oil and refined petroleum products combined.) Moreover, global crude oil prices remain high by historic measures. They have been slightly above $100 a barrel on average for the last three years—and only for the last three years.

US crude oil production reached 7.74 million barrels a day in October, down slightly from September because of disruptions from Hurricane Karen, but up 17 percent from the year before. Aside from September, US production in October was the highest level of any month since May 1989.

Iran’s oil production has been fairly steady at 2.7 million barrels a day since punishing sanctions were imposed in mid-2012. Sixty percent of Iran’s production is consumed at home.

US net crude oil imports in October fell to 7.57 million barrels a day, down from 7.92 million barrels in September and down 8 percent from the year before. While the United States hasn’t bought Iranian oil in decades, the reduction in US imports frees up more oil from abroad for sales to countries that are cutting their Iranian oil buys.

Mark Zandi, an Iranian-American born in Atlanta and now chief economist of Moody’s Analytics, said rising domestic oil production “means a smaller trade and current account deficit, which is a big plus for the economy. We’ll be less sensitive to increases in global oil prices.”

According to figures compiled by Zandi, the US oil import bill as a percentage of the US gross domestic product in the third quarter of this year was lower than in any quarter since 1986.

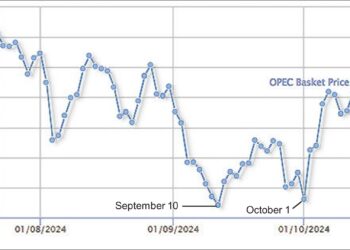

Furthermore, US gasoline prices at the pump have been rapidly falling in recent months while the price of OPEC oil has remained steady.

The turnaround in US oil fortunes has been rapid. Five years ago, US oil production hit a 62-year low. Since then, domestic production has increased by more than 50 percent.