August 06, 2021

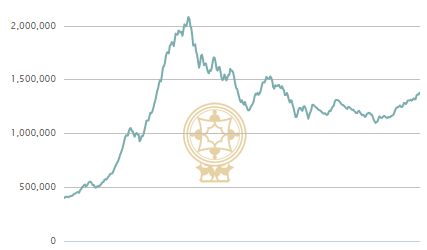

The Tehran Stock Exchange (TSE) is sputtering, failing to regain its huge losses of late last year, but also not dropping further.

The exchange’s main index, TEDPIX, lost almost half its value at one point and has regained only modestly since then. One key reason is that a huge proportion of investors have simply given up on stocks and moved their money elsewhere.

The Financial Tribune reported that the amount of capital invested in the stock market in the first two months of the current Persian year totaled 284 trillion rials ($1.1 billion), which was down a whopping 55 percent from the 631 trillion rials ($2.5 billion) invested in the same period of the previous year.

The TEDPIX set a new post-boom low on May 24 of 1,095,098. That was 47 percent down from the high last August 9 of 2,078,512. The index has risen modestly since then to x, xxx, xxx on August 9 this year, the first anniversary of the record-setting high point.

But that is still down xx percent since the high of last August. And with the new funds being invested in stocks down by more than half, the likelihood of any substantial recovery would appear to be very low.

Meanwhile, the Iranian Students Polling Agency (ISPA) said it surveyed 1,585 adult Iranians and found that 21 percent said they had invested in the stock market in the last 24 months. More importantly, 77 percent of them said they had lost money and another 15 percent said they broke even leaving only 8 percent who made a profit on their stock investments.

That suggests there aren’t a lot of people who feel like sinking more money into the stock market.

The decline in the stock market doesn’t just mean losses for some investors. It means a major shift in the economy.

To raise capital for businesses, companies have two options, namely equity financing (selling stock in their firm) and debt financing (borrowing).

Citing data released by the Securities and Exchange Organization (SEO), the Tehran Chamber of Commerce said the stock market’s decline has meant a shift from equity financing to debt financing.

But perhaps even more important, it said the total capital available from both equity and debt financing has plummeted 43 percent from the first two months of the last Persian year to the first two months of this year a devastating drop.

Equity financing fell from 631 trillion rials ($2.6 billion) in the first two months of last year to 284 trillion rials ($1.2 billion) in the corresponding period this year, a stunning 55 percent decline.

Debt financing increased more than 31 percent to reach 120 trillion rials ($510 million), rising from 82 trillion rials ($348m) in the first two months of the previous year.

Equity financing is the method of raising capital by selling company stocks while debt financing occurs when a firm raises money by selling debt instruments to individuals and institutional investors.

Equity financing has no repayment obligation and provides extra working capital that can be used to grow a business. Debt financing, on the other hand, does not require giving up a portion of ownership.