May 14, 2021

Furthermore, many investors offering stocks for sale are failing to find any buyers a sure-fire indicator that the public is disillusioned with the stock market and seeking to bail out.

In the first 31 trading days since Now Ruz, the TEDPIX, the market’s main index, has fallen on all but six of those days.

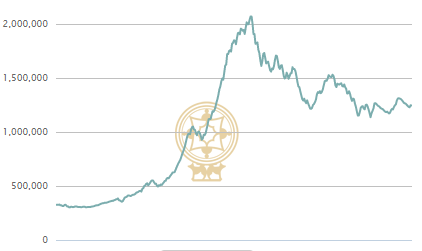

The TEDPIX soared at an astounding rate last year during the early months of the coronavirus epidemic, when almost every other stock market in the world declined.

The TEDPIX was already rising and stood at 475,000 in mid-February when Iran announced its first coronavirus deaths.

Just six months later, the TEDPIX hit its all-time high of 2,078,518 on August 9, a rise of 4.4 times in a mere half-year.

But in the next five months, the index was almost halved, plummeting to 1,135,145 on February 6.

It recovered slightly in the remaining weeks of the Persian year and started the new year at 1,309,561.

But since then, it has been on a gentle downward slide, reaching x,xxx,xxx on May xx.

And there is no indication that any recovery is in the offing. The Financial Tribune wrote on April 18 of the “visible lack of interest” in the stock market. It said the total value of all trades that day was the lowest in the two years since April 2019, an indicator that investors are bailing out of the stock market.

The newspaper said 15 trillion rials in shares were sold that day. But, more importantly, 51 trillion rials worth of stock was put up for sale that day and found no buyers. In other words, only 23 percent of the stock put on the market could find buyers, an indication of the scale of investors who want out of the stock market.

The political system is under growing pressure to do something to help those who lost a lot of money with the collapse. On May 3, the Supreme Council of Economic Coordination (SCEC) which is comprised of the president, Majlis speaker and Judiciary chairman adopted several measures. One authorizes the National Development Fund of Iran the country’s sovereign wealth fund—to buy stocks in an effort to prop up the market. No one has said how much money will be put into the stock market.

Another measure is a direct bailout. People who bought two government-owned exchange-traded funds (ETFs) will now be compensated directly for their losses.

Meanwhile, the Securities and Exchange Organization (SEO), which regulates the stock market, rolled back what it thought was an initiative that would halt the downward slide. For years until February, the SEO allowed a stock’s prices to fluctuate daily by a maximum of 5 percent up or 5 percent down. In February, the SEO decided to change that to 2 percent down or 6 percent up daily. As of May 15, the rule reverts to the old plus-or-minus 5 percent.