February 19, 2016

The decision itself was not significant in practical terms. Russian output in January was the highest for any month since the collapse of the Soviet Union a quarter century ago. The freeze won’t change that. Saudi output in January was down marginally from previous months.

The decision is, however, important symbolically as it is the first, however tentative, move to jointly address the over-supply of crude.

Venezuela and Qatar also joined in the freeze agreement, reached at a meeting of the four countries in Qatar.

But neither Iran nor Iraq was in attendance—and they must be key parties to any agreement since both have announced plans to boost output significantly this year.

As of the Iran Times’ deadline, Iran had not responded officially to the freeze decision. An Iranian source, however, told Reuters Iran would be willing to discuss a freeze—but only after Iranian output has risen 1 million barrels a day and returned to the levels before the harsh sanctions were imposed in 2012.

Saudi Foreign Minister Ali An-Naimi made clear that the freeze decision was the start of a process and not a meaningful policy in and of itself. He said, “The reason we agreed to a potential freeze of production is simply the beginning of a process to assess in the next few months and decide whether we need other steps to stabilize the market.”

Note that Naimi referred to the agreement as a “potential” freeze. Russia’s Energy Ministry issued a statement saying its willingness to freeze output is conditional on others joining with the four who signed on to the freeze Tuesday. But, significantly, Russia said it would be willing to consider actual cuts to output if the freeze agreement received wide acceptance.

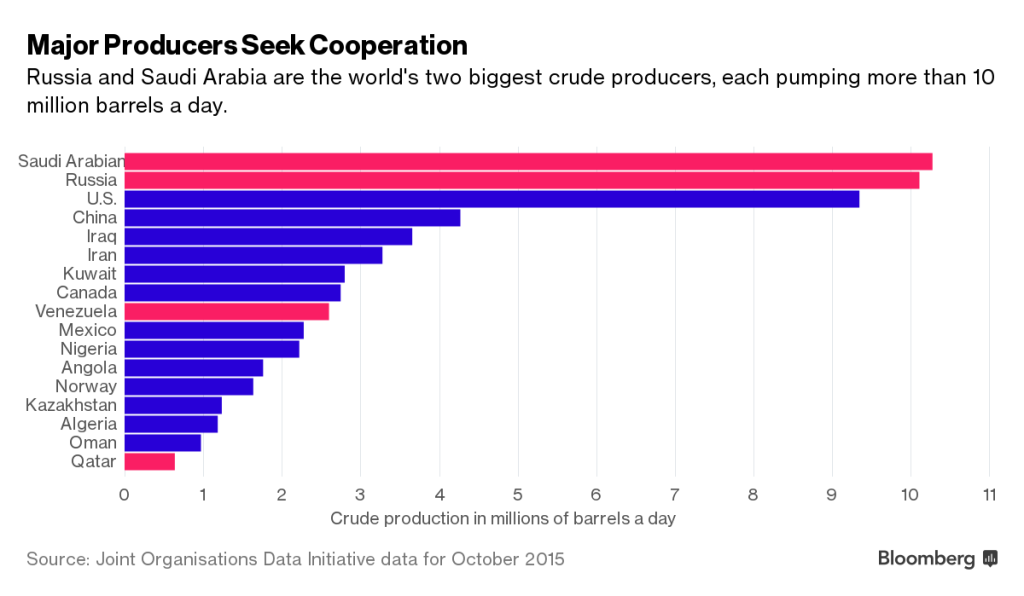

The Saudis have long been consistent in saying they would agree to a reduction in OPEC output only if other major oil exporters outside OPEC joined in cuts. Russia is by far the major oil exporter outside OPEC. Canada, Mexico and Norway are the others. Canada and Norway have always refused to join cartel-like production agreements. Mexico has joined them in the past, but has been silent recently.

OPEC won’t have a joint position to take to the others without Iran and Iraq on board. Qatar’s oil minister Mohammed al-Sada said, “We think other producers need to freeze straight away, including Iran and Iraq. We believe this step is meant to stabilize the market.” That kind of talk is likely to be seen in Tehran as a sneaky Arab ploy, however.

Venezuela’s Oil Minister Eulogio Del Pino said talks would take place with Iran and Iraq this week after the Iran Times went to press. The Venezuelan has been traveling among oil exporters trying to broker an agreement and was the midwife of the meeting in Qatar that produced the freeze announcement. The freeze was reportedly his idea.

Iraq has long said it expects its production to rise further this year, but last month said it was ready reduce its fast-growing output if all OPEC and non-OPEC members agreed. That aligned it with Saudi Arabia.

Saudi Arabia has long insisted it would reduce supply only if other OPEC and non-OPEC members agreed, but Russia, the No.2 exporter, has said it would not join in as its Siberian fields were different from those of OPEC. The new agreement indicated it has shifted attitude.

The mood began to change only in January as oil prices fell below $30 per barrel.

Energy Aspects’ analyst Dominic Haywood told Reuters, “Even if they do freeze production at January levels, you have still got global inventory builds which are going to weigh on prices. So whilst it’s a positive step, I don’t think it will have a huge impact on supply/demand balances, simply because we were oversupplied in January anyway.”

The new agreement may also be seen as a trust test for Russia. In 2001, Saudi Arabia pushed through a curb on output by both OPEC and non-OPEC exporters. Russia signed on to that agreement—but then failed to carry through on production cuts. The Saudis understandably lack trust in Moscow. That disdain for Russia is also fed by the conflicting Saudi and Russian policies today on Syria.

The two counties have been engaged in a battle over markets this past year. Riyadh launched a direct challenge to Moscow by selling crude in Eastern Europe, Russia’s backyard. And Russia overtook Saudi Arabia in crude sales to China.

According to figures published by the International Energy Agency (IEA), Russia pumped 10.9 million barrels a day in January, a post-Soviet record. The Saudis pumped 10.2 million, down from their recent peak of 10.5 million last June. Iraq’s output in January was an all-time record of 4.35 million barrels a day.