February 17, 2023

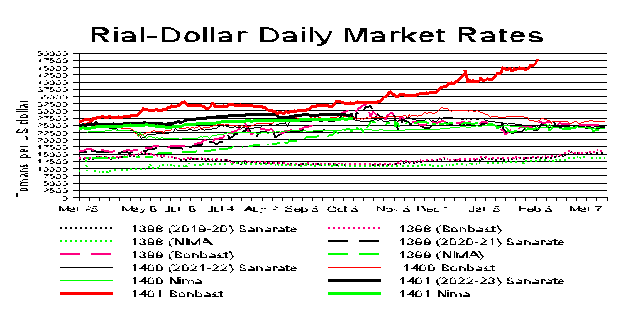

The rial passed above 450,000 to the dollar for the first time February 9 and passed 475,000 just seven later with no end in sight. And, also for the first time, the United States Federal Reserve System is now helping to strangle the rial.

The rial passed 400,000 for the first time December 22 and has been above 400,000 every day since January 3. It has been above 430,000 every day since January 18 and above 440,000 every day since January 29. A high of 476,500 was reached February 16.

The government poured dollars into the market in late December to try to restrain the rise. It managed to drive the price of the dollar down from 440,000 on December 28 to 398,000 on January 4. But then it seemed to run out of dollars and the price began rising again.

The rial topped 300,000 to the dollar never again to fall lower last September 3. In the not-quite six months since then, it has lost fully a third of its value.

However, what many people are pointing to is the fact that the dollar went for 255,000 rials on August 5, 2021 the day President Raisi was inaugurated. In the year-and-a-half since then, the rial has lost 43 percent of its value.

The rial is losing value in part because of inflation, which is now back up above 50 percent a year. And it’s losing value in part because the economy is in such miserable condition. And it’s losing value because so many Iranians are sending their money out of the country.

But there’s a new factor at play. Since late last year, the United States has been squeezing dollars out of Iraq dollars that were being moved into Iran to keep it afloat.

Since the US invasion of Iraq in 2003, Iraq’s foreign currency reserves have been housed at the US Federal Reserve Bank in New York, giving the Americans significant control over Iraq’s supply of dollars. The Central Bank of Iraq requests dollars from the Fed and then sells them to commercial banks and exchange houses at the official (and cheap) exchange rate through a mechanism known as the “dollar auction.”

In the past, daily sales through the Baghdad auction often exceeded $200 million per day. But no longer.

Ostensibly, the vast majority of the dollars sold in the auction are meant to pay for goods imported by Iraqi companies, but the system has long been porous and easily abused, multiple Iraqi banking and political officials told The Associated Press.

US officials confirmed to the AP that they suspected the system was used for money laundering, much of it to benefit Iran despite Tehran’s almost daily boasts about how it has gained independence from the dollar and is now helping to grind it into insignificance.

For years, large quantities of dollars were transferred out of Iraq to Turkiye, the United Arab Emirates, Jordan and Lebanon through “gray market trading, using fake invoices for overpriced items,” a financial adviser to the Iraqi prime minister told the AP.

The inflated invoices were used to launder dollars, with most of them sent to Iran and Syria, which are both under US sanctions.

Tamkeen Abd Sarhan al-Hasnawi, chairman of the board of Mosul Bank and first deputy of the Iraq Private Banks League, estimated that as much as 80 percent of the dollars sold through the auction went to neighboring countries. “Syria, Turkey and Iran used to benefit from the dollar auction in Iraq,” he said.

Late last year, the Fed began imposing stricter measures.

Among other steps, at the request of the US, the Central Bank of Iraq started using an electronic system for transfers that required entering detailed information on the intended end-recipient of the requested dollars. One hundred Central Bank employees were trained by the Fed to implement the new system, the prime minister’s financial adviser said.

“This system started rejecting transfers and invoices that used to be approved by the Central Bank,” he said. “Around 80 percent of transactions are being rejected.”

The volume of dollars sold daily in the auction plummeted to $69.6 million on January 31, down from $257.8 million six months earlier, according to Central Bank records.

In Tehran, the regime is trying all sorts of ineffective methods in an effort to stop the decline of the rial. For example, in early January, Hedayat Bahrami, the chief of the financial police, said his men had detained 153 people for driving up the price of foreign exchange “by arranging fake deals.”

The regime is also selling gold coins on the stock market. The government gets the money from the sales up front, but the public won’t get the gold coins until some future date, which the government has yet to announce. The public finds this attractive because they assume the gold coins will be worth much more than today’s rial even if they have to wait months to get the coins. Another tried and true method just used to bolster the rial was to fire Central Bank Governor Ali Salehabadi and replace him on December 29 with Mohammad-Reza Farzin, who had been CEO of Bank Melli for the previous year. That did absolutely nothing to help prop up the rial.