July 19, 2019

The rial has strengthened against the dollar in recent days with the dollar now selling for around 120,000 rials, an improvement of 10 percent in the last two weeks.

The rial has strengthened against the dollar in recent days with the dollar now selling for around 120,000 rials, an improvement of 10 percent in the last two weeks.

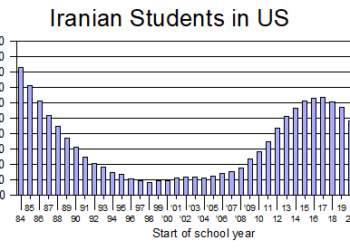

The Bonbast website (red line on chart) showed the price at 133,000 on July 6 and 120,000 on July 18. The Sanarate (black line on chart) posting, run by the Central Bank of Iran, put the dollar at 127,501 on July 6 and 118,550 on July 18.

Two other websites monitored by the Iran Times showed slightly different numbers for those days but similar strengthening.

What is odd and noteworthy is that the NIMA market, which is maintained by the Central Bank only for importers to buy foreign exchange, shows the price of the dollar going in the opposite direction (see green line on chart). While the rial has strengthened against the dollar on the open market, it has weakened against the dollar on NIMA.

Back in April and May, the difference in the prices on the two markets was greater than 40,000 rials. But as of July 18, the difference was just 1,631 rials.

Central Bank Governor Abdolnasser Hemmati boasted of that, saying the bank has long sought to have the two prices converge. What he failed to mention, however, is that he said a few months ago that he expected them to converge around 80,000 rials to the dollar, not 120,000. The prices are 50 percent greater than he predicted.

As is normal when the rial strengthens against the dollar, the Tehran Stock Exchange (TSE) has suffered. The stock market is often a parking place for rials when the rial is weak against other currencies. The TSE index reached an all-time high of 253,578 on July 17, but fell 2.7 percent just three days later to 246,790 on July 17. Still, the TSE index only passed 200,000 late in April so 247,000 in July is not exactly something to cry about.

The reason for the strengthening rial is not entirely clear. It comes at a time when Iran and the United States continue to exchange verbal brickbats. Some thought the stronger rial came about because investors had decided the nasty words filling the airwaves were just so much hot air and a real war was unlikely.

Masud Gholampur, an analyst at Tehran’s Novin Investment Bank, suggested a key cause of the rial’s strengthening is the ban on luxury imports, which has greatly reduced the opportunity to pour money into such goods. But that ban went into effect months ago, not weeks ago.

Economist Navid Kalhor questioned whether the strengthening shown on the open market sales (the red and black lines on the chart) really means much. He wrote that foreign exchange shops can only sell foreign exchange provided by the Central Bank and that volume doesn’t meet demand. As a result, many people still go to illegal curbside sellers. But it isn’t known how much of the demand they satisfy or at what prices.