March 15, 2019

The rial is no longer wildly erratic, but it certainly is not showing anything like strength as the Persian year comes to an end. It has lost a third of its value in the last three months.

The rial is no longer wildly erratic, but it certainly is not showing anything like strength as the Persian year comes to an end. It has lost a third of its value in the last three months.

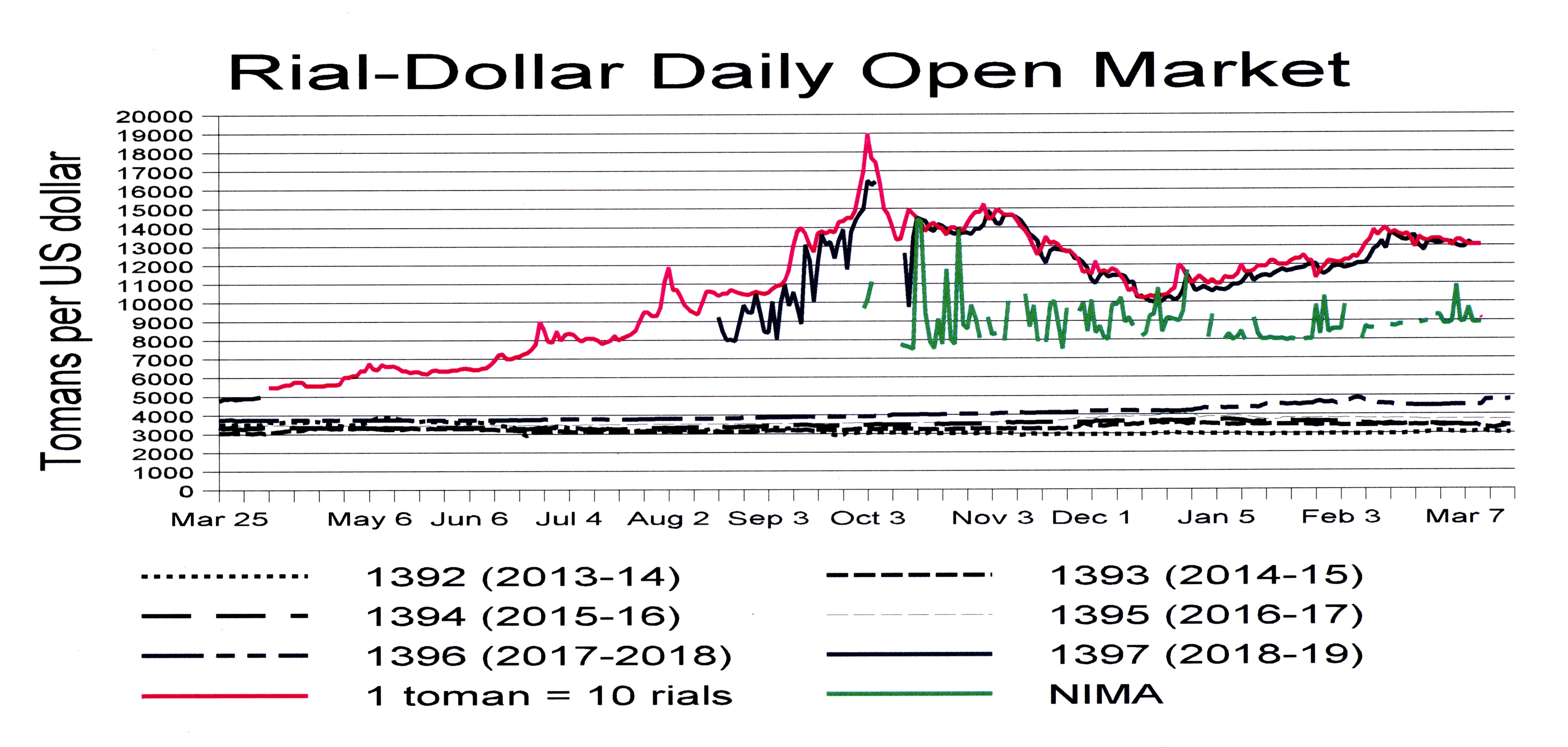

The rial began a period of slow but accelerating collapse after last Now Ruz, rising from just under 50,000 to the dollar at Now Ruz to 150,000 in late September. It then spiked briefly to 190,000 but returned to 150,000 after just one week.

It then strengthened to 100,000 once again by mid-December. But since then it has slid to 140,000 before recovering in the last two weeks and settling in a little over 130,000. On the chart, the loss from last December doesn’t look like much, but it amounts to a devastating loss of almost one-third in value in three months.

The green line on the chart is the daily sales at Nima, the exchange reserved for importers to get their foreign exchange. The price there has recently settled around 90,000 rials to the dollar. But notice the many gaps. Those are days with no sales, presumably because there is not very much foreign exchange being sold there.

In mid-February, the Central Bank devised a new incentive package to encourage exporters to sell more of their foreign exchange earnings on Nima. But there have been more gaps since then, suggesting the Central Bank incentives have actually been disincentives.

Meanwhile, Hellenic Shipping News reports that many ships are anchored off shore Iran because they haven’t been paid for cargoes of food and won’t dock until they have been paid. It says that firms like Bunge and Cargill, which are both American but can continue to do business with Iran in agricultural and medical goods, often dispatch cargoes without first receiving payment, but get the payment while the ships are in transit. But Iran hasn’t paid.

Agricultural goods and medicines can be imported with foreign exchange sold by the Central Bank for 42,000 rials to the dollar. But Hellenic says the foreign exchange hasn’t been coming through, leaving ships loaded mainly with soybeans and maize stranded offshore awaiting word on a payment.

A year ago, one big scandal erupted when it was found that people getting the heavily subsidized money at 42,000 rials to the dollar weren’t all buying food and pharmaceuticals; many were actually buying consumer goods. So, the Central Bank says it is now policing what’s done with the subsidized foreign exchange, which may be the cause of the bottlenecks.

Meanwhile, Asadollah Asgaroladi, the chairman of the Iran-China Joint Chamber of Commerce, says he stopped exporting anything to China in mid-November because the foreign exchange chaos meant he could not count on being paid. “After 64 years of export activities, for the first time I had to suspend exports,” he told a meeting of the chamber.

In mid-February, Tehran Police Chief General Hossain Karimi said 190 currency dealers were currently in jail. He said all “unauthorized” currency exchange bureaus had been shut down and threatened all those engaged in selling foreign exchange over social media at “inflated prices.”