March 17, 2023

The rial has recovered very dramatically in March as the government has thrown dollars onto the foreign exchange market, but it remains to be seen how long it can keep this up.

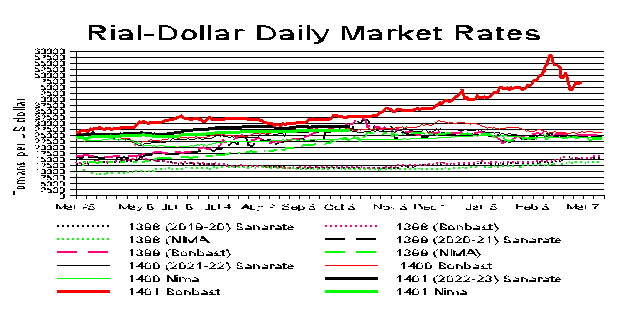

The rial topped 601,500 to the dollar very briefly on February 26, the highest ever in history. One week later it had fallen below 500,000. A week after that, on March 12, the price was 438,000. Two days before the last business day of the Persian year, March 17, the price was 473x,000 rials.

If the government keeps throwing dollars into the foreign exchange market, it will eventually run out of dollars and the rial could lose value very quickly.

Ships loaded with goods continue to sit offshore unloaded because the government hasn’t been able to pay for their cargoes. That suggests the government is using dollars intended for imports to prop up the foreign exchange market.

As of February 21, the government scrapped its long-standing practice of allowing citizens traveling abroad to buy up to $2,000 a year at rates slightly below the free market and instead imposed a limit of $500, further indication that the state is running short of foreign exchange.

That same day, the Central Bank set up a new “Iran Center for Exchange” (ICE) that is intended eventually to handle all wholesale foreign exchange and gold sales. Central Bank Governor Mohammad-Reza Farzin said, “Our ultimate goal is to stabilize rates in this system at or near 285,000 rials to the dollar.”

He said ICE is intended to be “a new approach to managing the foreign exchange market.” That new approach does not appear to reflect free market principles. Farzin said the ICE would set currency exchange rates “based on demand/supply of currency and gold as well as key economic indicators.” But having a government entity set exchange rates is the exact opposite of free market principles where open judgments of supply and demand prevail.

As for the recent surges in the prices of foreign currencies, Farzin blamed then on “price-gouging.” He didn’t name any price gougers.

As the public questioned where the foreign exchange being used to prop up the market was coming from, Farzin announced that part of Iran’s funds frozen aboard by US sanctions had been released and injected into the market. No country holding frozen Iranian funds has said anything about any funds being freed. The US said nothing had changed on its sanctions rules freezing Iranian funds.

Meanwhile, many people have returned to the Tehran Stock Exchange, parking their rials there. The market rapidly rose -though it was still 20 percent below the all-time high set in August 2020. What is clear is that people are trying to get out of the rial and put their money into almost anything apart from the rial-foreign currency, stocks, gold, real estate and in banks abroad.