June 17, 2022

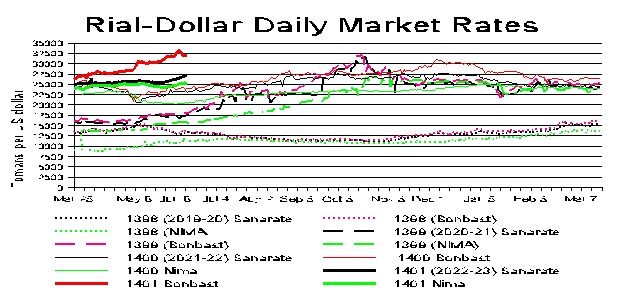

The previous low point for the rial was 322,000 to the dollar on October 15, 2020, 19 months ago. At that time, the rial spiked only briefly. In fact, it sold for more than 300,000 to the dollar for only nine days that October. It never again passed the 300,000 mark until last December, when it was 300,000 or above on 18 days, hitting a high of 311,000.

It then settled down to as low as 277,000. But it began to lose value at an accelerated pace in May, going from 281,000 on May 1 to 293,000 on May 10 and 307,500 on May 12. It then settled down for 2-1/2 weeks before springing to 318,000 on June 1 and continuing its value loss since then.

On June 1 of last year, the dollar sold for 242,000 rials and the year before that it went for 177,400 rials and three years ago for 137,000 rials. In other words, in the last three years, the currency has lost 58 percent of its value.

Politically, many people look at the changes since President Raisi took office last August 5. The dollar sold that day for 255,000 rials. So, it has lost 27 percent of its value in the 10 months Raisi has been in office.

The rial has essentially been on a downward passage for 40 years, ever since the revolution, looking a bit like a stairway, dropping sharply and quickly, then leveling off for a while, before dropping swiftly and precipitously again. The dollar cost only 70 rials before the revolution, so the last four decades have seen it lose 99.7 percent of its pre-revolution value.

On June 2, a week before the rial set a record low, the media reported that the heads of the three branches of government—the highest policy-making body in the government comprised of President Raisi, Majlis Speaker Mohmmad-Baqer Qalibaf and Judiciary Chairman Gholam-Hossain Mohseni-Ejai—had given the Central Bank a special mandate to intervene in the foreign exchange market.

The bank has not announced any new policies. But Central Bank Governor Ali Salehabadi said June 12 he would incrase the supply of foreign banknote in the market. “The Central Bank is prepared to meet all foreign exchange needs,” he said, without saying when the foreign currency would materialize—or where it would come from. Whatever he has subsequently done, it hasn’t worked so far to save the rial from sinking yet further in value.

Meanwhile, in a traditional regime response, the police arrested 31 currency and gold traders, accusing them of creating “false demand” in the market.

Most commonly, analysts placed blame for the rial’s latest decline on the new assumption that the talks to revive the JCPOA are now dead and sanctions will not only continue but also increase.