December 20, 2024

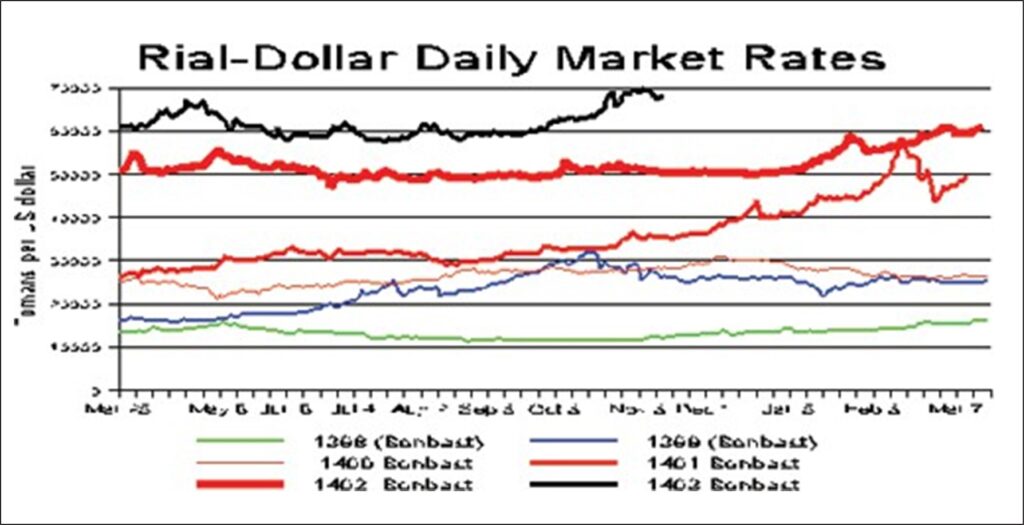

The rial has been sliding inexorably, setting new record lows repeatedly since late October and has lost just a hair short of one-third of its value since President Pezesh-kian took office in August.

In the 48 days since November 1, the website Bonbast, which tracks daily open market sales, has reported new lows on 17 of those 48 days. The rial has dropped from 694,000, a new low, on November 1, to 776,500, another new low, on December 18. That is a drop of 11.9 percent in just six weeks.

It first passed 700,000, albeit just briefly, on November 6, the day it was announced that Donald Trump had been elected president.

That was a major historical figure since the dollar went for 70 rials to the dollar for decades before the revolution At 700,000, the rial was worth just 0.01 percent (1/100th of 1 percent) of what it was worth before the revolution. And now it is worth much less than that as the rial continues to lose value almost every other day.

Syrian President Bashar al-Assad fled to Moscow December 8. The next day the rial set a new low of 732,000. The rial then lost 5.7 percent of its value in the next eight days, suggesting the political earthquake in Syria was contributing mightily to the rial’s recent woes.

Some, however, see the new lows as a repudiation of President Pezeshkian. The currency sold for 584,000 to the dollar when he took office at the beginning of August. So, it has lost almost a third of its value a whopping loss in the first 4-1/2 months of Pezeshkian’s term. But his term has seen such events as the assassination in Tehran of Hamas’s leader, Israel’s second air attack on Iran, Trump’s election and Assad’s fall, none of which Pezeshkian had any say over and all of which pummeled the rial.

Before the latest spike, the previous record low for the rial was 670,000, set in mid-April when the country was awaiting Israel’s retaliation for the first Iranian missile barrage on Israel on April 1.

Both Israeli retaliations were far more modest than most in Iran had feared. And after both retaliations, the rial settled back down. It has been the norm for the rial to spike briefly, set a new record against the dollar and then quickly retreat for some months before a new fear sets off a new spike. The retreat is usually attributed to the Central Bank injecting new dollars into the market to stop the spike.

What has been a constant has been the long-term, abysmal decline in the value of the rial for the entire 45 years since the revolution. Many countries have gone through horrifying bouts of inflation, but have then imposed financial reforms that have cured the problem and restored stability to the national currency. Iran has gone through almost a half-century of high but not stunning inflation.

The post-World War II hyperinflation of Hungary holds the record for the most extreme monthly inflation rate ever 41.9 quadrillion percent (4.19◊1016%; 41,900,000,000,000,000%) for July 1946, amounting to prices doubling every 15.3 hours.