March 25, 2022

Swaths of the Iranian economy have retooled in response to more than three years of US sanctions, finding pockets of resilience in the country’s large domestic economy.

The regime uses the term “Resistance Economy,” meaning that Iran must learned to make goods that it previously imported and also make goods that it can export to make up for the losses due to sanctions drastically reducing oil exports.

There is little sign of product exports. Most Iranian exports continue to be from the petroleum sector, although now there is much more export of petrochemicals than of crude oil.

However, The Wall Street Journal reports that Iranian companies are increasingly producing the sorts of goods that Iran had long imported from abroad, while smaller, growing companies have picked up hiring. According to Iranian government statistics, Iran’s non-oil industry’s gross revenues have grown 83 percent in the past couple of years, overtaking the sanctions-battered energy sector. The numbers must be taken with a grain of salt given Iran’s huge inflation rate, which has exceeded 30 percent in all of the last four years.

“Even if sanctions severed Iran’s entire oil exports, the country’s economy could continue to survive,” Mohsen Tavakol, a sanctions expert at the Atlantic Council, told the Journal.

In some quarters, the Iranian economy is adjusting to being cut off from much of international commerce.

For instance, after US sanctions prompted French cosmetics company L’Oreal in 2018 to abandon acquisition talks with Zarsima Nami Rasa, the Iranian firm launched its own line of products that have since replaced its former suitor’s brand in many of Tehran’s hair salons, the Journal reported.

“Sanctions were the right nudge for us,” said Hassan Oskoui, managing director at Zarsima Nami Rasa, an Iranian beauty-care company. The company said its domestic focus allowed it to retain about 450 workers.

Home-appliance manufacturer Pakshoma Co. also took advantage of the departure of much larger South Korean competitors, LG Electronics and Samsung. It developed the first domestically produced dishwasher, called the Josephine, after the American inventor of the machine Josephine Cochrane.

Its sales of dishwashers and washing machines surged 40 percent and 55 percent over the next two years, allowing the company to hire 600 workers, Mehrdad Nikzad, the manufacturer’s marketing manager, told the Journal.

At the Iran Mall in Tehran, which opened in 2018, foreign brands like Adidas, Benetton and Mango have been replaced by local brands, many of them knockoffs of foreign counterparts.

Nimble small and medium-size companies are driving the growth of Iranian manufacturing. About 1,000 such enterprises have created or reinstated 17,000 jobs, the deputy head of Iran’s Small Industries and Industrial Parks Organization told the IRNA state news agency.

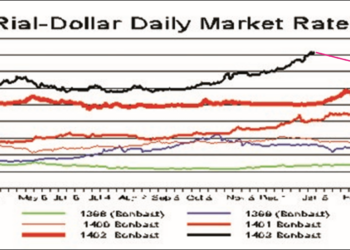

US officials have said they believe Tehran is only just surviving, pointing to scarce foreign-currency reserves and a plummeting rial exchange rate. They also say that they regard Tehran’s statistics as unreliable and that the government is hiding the true extent of economic damage it is suffering under the pressure campaign. However, the Journal noted that foreign economists and institutions like the World Bank and the International Monetary Fund use Iranian statistics as a basis for analyzing the country’s economy.

But not all is good. The share of Iranians living under $5.50 a day, the World Bank’s poverty line for upper-middle-income economies, rose to 13 percent in 2019, up from 8 percent in 2011, according to the World Bank.

“Rising employment doesn’t translate into higher income,” Djavad Salehi-Isfahani, professor of economics at Virginia Tech, said. “Poverty is rising, and I’m sure the government is aware of this and concerned.”

Some of Iran’s larger manufacturers, which rely on imported raw materials and don’t export, have hit harder times. Iran’s large automotive industry, for example, slashed output from 1.4 million cars in 2017 to 770,000 in 2019, according to the International Organization of Motor Vehicle Manufacturers.

But while families in times of crisis are unlikely to splurge on cars, consumption of everyday products has remained constant, said Omid Gholamifar, founder of the Sweden-based Serkland Invest, which specializes in investments in Iran. “Overall demand is healthy and it needs to be filled by someone,” he told the Journal.

Gholamifar has invested in four Iranian companies producing consumer goods—a pharmaceuticals company, a food retailer, an industrial packaging company and a home-care company. All of them have increased their sales volume by 25 percent to 30 percent annually after President Trump re-imposed sanctions, he said.

While parts of the Iranian economy are weathering the country’s stormy relationship with the US so far, many face trouble ahead. As long as foreign investors avoid Iran, the country’s capital-constrained and technology-restricted manufacturing sector will struggle to grow, say economists.

“In the past three to four years, the infrastructure and technology haven’t been updated or modernized the way they should have been,” said Mohammad Taheri, editor-in-chief of the economic weekly Tejarat Farda. “If the supply of cheap fuel to factories is stopped, and if they cannot mend the low-efficiency that is ruling the industry now, this situation cannot continue.”

Any efforts to address cash shortages by printing money will fuel inflation, further compounding the pain of Iranian families, according to Adnan Mazaeri, a nonresident fellow with the Peterson Institute for International Economics in Washington.

“Iran can withstand maybe a year more of this,” he said. “People’s absorption of pain has limits too.”