December 13-2013

OPEC ministers had a pleasant stay in Vienna last Wednesday but avoided making any difficult decisions, as the cartel continued on cruise control.

The organization decided to continue its overall production ceiling of 30 million barrels a day, although its own staff said that was above the global demand for OPEC output.

And the ministers once again were unable to resolve the competition between Iran, Iraq and Saudi Arabia for filling the post of secretary general of the organization. None of the three countries has been willing to withdraw and the other members don’t want to take sides.

As a result, OPEC just re-appointed outgoing Secretary General Abdallah El-Badri of Libya. His maximum of two three-year terms was up last December. He was then reappointed for six months when the three-way squabble could not be resolved. At the last OPEC meeting in June, he was re-appointed for another six months. This time he was re-appointed for a full year, indicating the other nine members of group don’t even want to see the matter on its agenda when it meets again June 11.

The OPEC staff estimated demand for OPEC output at 29.57 million barrels a day in 2014, but the ministers went ahead and just rolled over its 30-million barrel ceiling yet again. The ceiling doesn’t really mean very much; since OPEC abolished individual country ceilings a few years ago, there is no way to police individual members anyway, making the organization little more than a shell.

But OPEC production could increase with market forecasters watching Iran, Iraq and Libya.

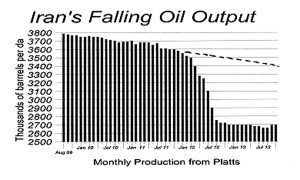

Regarding Iran, commentators noted remarks by Iranian Oil Minister Bijan Namdar-Zanganeh that Iran was prepared to boost production back up to 4.0 million barrels a day with sanctions being lifted. But sanctions aren’t being lifted under the interim deal signed November 24, and few believe Iran capable of producing anywhere near 4.0 million. Iranian output was falling every month long before sanctions clamped down on sales, as shown in the accompanying chart. That slide was the result of aging oilfields that were not being properly maintained in order to keep up production. The dotted line on the chart shows that if the slide continued at the same rate as before, Iran’s capacity would be down today to around 3.4 million barrels a day. And many petroleum engineers say they suspect the shut-in of fields the past year has likely done further damage and thus further eroded Iran’s maximum output capacity.

As for Iraq, it has been investing heavily in oilfield development and told OPEC it expected to raise exports from 2.38 million barrels a day in November to 3.4 million next year. Analysts generally believe Iraqi exports will rise in the coming months—but not by that much.

With regard to Libya, exports have been cut back sharply to a mere 250,000 barrels a day as a result of disorder in the country and conflicts between militias. Libyan Oil Minister Abdelbari al-Arusi told OPEC he expected production would be back up to the normal 1.5 million before the end of the month. That is possible. But there is no guarantee it will stay there given the chaos that reigns in Libya.

The big concern among OPEC ministers, however, is the surging production of shale oil in the United States which has risen from zero a few years ago to 2.7 million barrels a day (the same as Iran’s total production currently) and is still rising, discombobulating the entire market.

Yet, despite that, the price of an OPEC barrel has remained steady at a little over $105 a barrel for three years now, a figure that warms every OPEC minister’s heart.

In its communique, OPEC said, “The biggest challenge facing global oil markets in 2014 is this global economic uncertainty, with the fragility of the euro-zone remaining a cause for concern,” meaning that OPEC fears a drop in demand if Europe’s economy contracts.

The communique went on, “It was also noted that, although world oil demand is forecast to increase during the year 2014, this will be more than offset by the projected increase in non-OPEC supply,” a nod to surging shale oil output in North America.

“Nevertheless, in the interest of maintaining market equilibrium, the conference decided to maintain the current production level of 30.0 million barrels a day.” The use of the word “nevertheless” telegraphed that the ministers acknowledge their decision defies logic.