May 10, 2024

Almost all of Iran’s exported oil goes to China and that’s Biden’s problem. But back in the Trump Administration, almost all of Iran’s oil exports also went to China and that was Trump’s problem.

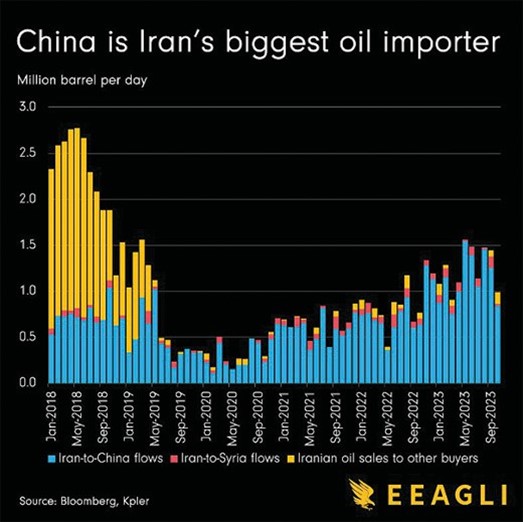

He couldn’t stop Iranian oil sales to China either. Washington’s hawks argue, correctly, that Iran has been exporting more oil over the last year than it has since Trump reimposed oil sanctions in 2018.

Biden has not halted Iran’s sales to China. But neither did Trump. Hardly anyone else is buying any Iranian oil, because sanctions have worked outside China. Syria gets a chunk of Iranian oil, but gets it on credit so Iran is not making any money off those sales right now.

China is taking well over 90 percent of Iran’s oil exports. Bloomberg says that fresh measures and tougher enforcement will struggle to curtail the Islamic Republic’s key source of income “thanks to China’s appetite for discounted crude, and what traders, analysts and oil industry executives describe as expanded payment and transport networks that the US cannot reach.”

The crude goes to China aboard a “dark fleet” of tankers that don’t do business with the US and don’t care about sanctions, is sold to small refineries that don’t do business outside China and so do not care about sanctions and is paid for through small Chinese banks that don’t do any business in the dollar or with the United States and don’t care about sanctions.

Following Trump’s departure from the nuclear deal in 2018, Tehran had to contend with a US campaign of ‘maximum pressure,” which sought to force it to abandon uranium enrichment and cut off aid for proxy militias. Washington threatened sanctions against countries that did not reduce Iranian oil to “zero.” But over the last three years, even accounting for some underreporting after 2018, Iran’s oil shipments have climbed.

“The trade is very sophisticated, with multiple middlemen, which makes it a lot more difficult for the US to sanction. The US can hit companies that are more public or obvious in their Iranian dealings, but many of these middlemen are small entities,” Homayoun Falakshahi, senior oil analyst at data and analytics group Kpler, told Bloomberg.

China’s big oil firms, like Sinopec, have stopped buying Iranian oil under US pressure from the Biden Administration. The oil now goes to small Chinese refineries called “teapots.” They don’t do business with the United States or US businesses, so they don’t come face-to-face with US sanctions. They simply don’t care about US sanctions. Of course, somebody has to carry the Iranian crude from the Persian Gulf to China aboard tankers. But there are now hundreds of crude tankers in the socalled “dark fleet”ships that only carry sanctioned oil from Iran and Russia and thus stay beyond Washington’s reach.

“The trade with China is probably something the US would struggle to entirely shut down,” Raffaello Pantucci, a senior fellow at the S. Rajaratnam School of International Studies in Singapore, told Bloomberg. “They could put more pressure on Chinese companies if they focus investigations, determine links and extend the range of sanctions. But they’ve extended quite a few sanctions to various Chinese entities already.” Of course, the Chinese have to pay for that Iranian oil and banks are the main target of sanctions.

Teapots, however, have long used smaller financial institutions like Bank of Kunlun, which stay away from the dollar and thus are untouched by US sanctions. More recently, Chinese importers have benefited from the development of a yuan-based alternative to Western clearinghouses a platform known as CIPS, Cross-border Interbank Payments System, launched by China’s central bank to settle international claims.

Again, that ducks under US sanctions regardless of whom is president. Then, there are those middlemen who arrange sales for Iran. “If you find a middleman and decide to go harsh, they’ll go out of business. But many of these firms are shell companies with fake offices,” said Kpler’s Falakshahi. “The same people can easily set up another new company in one or two months.

The impact will be temporary.” Michal Meidan, director of the China Energy Program at the Oxford Institute for Energy Studies, points to China’s use of tools like the digital yuan and the dark fleet as a “lifeline to producers.” New legislation that just passed Congress and was signed by President Biden in April targets ports in China that land Iranian oil.

The hope is that ports, dealing with ships from all over the world, will not be able to duck sanctions that stop most ships from docking there. However, most of the teapots are in one province with seven ports.

If all the Iranian oil was landed at just one of those ports, which was then sanctioned, the other ports would be able to function normally and the one port used for Iranian oil might do well just handling sanctioned goods from Iran and Russia. Or, there are other possibilities, such as incorporating one dock in a Chinese harbor being used by Iran as an independent firm that would only handle sanctioned work and insulate the rest of a port from sanctions.

For its part, Iran has few options for its oil besides China since sanctions are working quite well elsewhere around the world. Beijing has every reason to take advantage mainly because Iran must sell its crude at a considerable discount.