February 21-2014

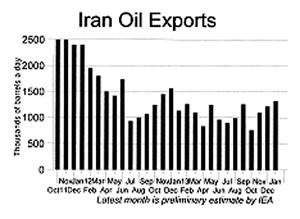

The Paris-based International Energy Agency (IEA) estimated Iran’s January exports at 1.32 million barrels a day. That was the highest monthly figure since December 2012, when exports were put at 1.56 million barrels a day.

Much of the news coverage spoke of this as a dramatic development. Some analysts saw this as supporting Republican opponents of the negotiations with Iran who have argued that the Obama Administration is no longer treating Iran as a pariah state and sanctions will therefore dissolve and cease to be effective.

Other found this overdone, however.

US Under Secretary of State Wendy Sherman was asked about this as she arrived in Vienna for talks this week with Iran and the rest of the Big Six.

She dismissed the talk, saying, “There are always fluctuations in the amount of oil that is being bought…. This is very much anticipated, and so we look at the aggregate over time. And we’re quite satisfied with where we are.”

Others pointed out that 1.32 million barrels a day may be high compared to exports during 2013—but it is still quite low when compared with exports before sanctions, which averaged 2.5 million barrels a day for two decades.

The January figure was 24 percent higher than the average for 2012. But it was 47 percent lower than Iran’s pre-sanctions sales.

Furthermore, the IEA for the first time added Iranian oil sales to Syria into its total, and that had the effect of inflating the January number when compared to last year’s figures, which did not include Syria. Without the Syrian sales figure, the January number might not have been so high. But the IEA did not give the individual numbers for sales to each country, so that calculation could not be made.

The IEA indicated Iran had been unable to sell all it wanted to in January. The IEA said the total volume of oil stored in tankers parked offshore was 30 million barrels at the end of January, up from 28 million at the end of December.

The IEA report seemed to agree with Sherman and did not attribute the January rise to any collapse of sanctions. It said, “Despite the optimism generated by the successful conclusion of the Joint Plan of Action [between Iran and the Big Six], the vast majority of sanctions against Iran remain in effect.”

If the sanctions are indeed collapsing as a result of the agreement taking effect, that would not likely have shown up in the January statistics. The agreement took effect January 20. No sales made after that date would show up in the January figures, which are based on actual deliveries to other countries, none of which could have been completed in the last 11 days of January. Thus, the February figures will be the first ones to reflect any diminishment in sanctions.

However, United Against Nuclear Iran (UANI) said the collapse of sanctions began when the interim nuclear agreement was signed November 24. It argued that Iranian oil sales have risen 70 percent from 761,000 barrels a day last October to 1.32 million barrels a day in January. Mark Wallace, CEO of UANI, which argues for more and tighter sanctions, said, “Had oil sanctions remained in place and been fully enforced, Iran’s oil exports could have fallen to a level as low as 500,000 barrels by the end of 2014.”

Wallace said, “It is clear that the Geneva negotiations and the signing of the interim agreement significantly altered the outlook for Iran’s oil market and overall economy, due to both the easing of restrictions and the reduced risks for purchasers and traders. Now that the agreement is being implemented, Iran’s oil exports are in position to increase even further as tanker insurance provisions are relaxed and shipping costs reduce.”

In Iran, news coverage echoed what Wallace said, attributing the January rise to an easing of sanctions.

For example, the English service of the Fars news agency quoted the IEA report as saying: “Imports of Iranian crude rose by 100,000 barrels a day last month, with China, Japan and India taking more oil as a deal easing sanctions over Iran’s nuclear program took effect.” But that is not a quote from the IEA report and the IEA in no way linked the January rise to the “deal easing sanctions.”

Syria may now become much more dependent on Iranian oil. Syrian Oil Minister Suleiman al-Abbas announced last week that Syrian oil production has dropped 96 percent since the start of the civil war with most of Syria’s wells in areas of the country controlled by rebel troops.

However, while Iran may be shipping more oil to Syria, it is assumed that Syria is not paying for the oil. Therefore, any growth in sales may not be reflected in a similar growth in income.