January 31-2014

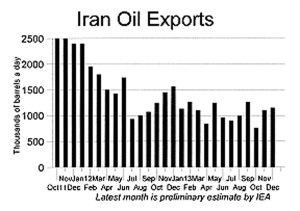

Iranian oil exports rose marginally last month, but not enough to make any difference in the year-long trend holding Iran’s oil sales to a little above 1 million barrels a day, which is 60 percent below the level that prevailed for two decades before sanctions battered Iran.

Iranian oil exports rose marginally last month, but not enough to make any difference in the year-long trend holding Iran’s oil sales to a little above 1 million barrels a day, which is 60 percent below the level that prevailed for two decades before sanctions battered Iran.

The monthly report of the International Energy Agency (IEA) said Iran’s exports in December came to 1.15 million barrels a day, up a hair from the 1.10 million barrels a day in November.

More importantly, the December exports were in line with the average for the last half of 2013, which was 1.027 million barrels.

The IEA is a Paris-based body of 28 oil-importing countries, something of a mirror image to OPEC, the Organization of Oil Exporting Countries.

As the accompanying chart shows, the IEA’s monthly figures went up and down and looked erratic throughout the year. But in reality, a low month usually meant a couple of shiploads were delayed and didn’t unload until the first days of the next month, which then showed a high figure, offsetting the previous month’s low figure.

The second half 2013 average of 1.027 million barrels a day was 6 percent lower than the first half average of 1.089 million barrels.

The US sanctions provide that buyers are to “substantially decrease” their procurement of Iranian oil each six months. The 6 percent drop in the last half of 2013 does not appear to be “substantial” at 6 percent. But Washington did not complain.

In the interim nuclear agreement between Iran and the Big Six, Washington agreed not to demand a further “significant decrease” in the next six months—but said it would not ease up otherwise. In other words, it will insist that Iran’s exports over the next six months be held to 1.027 million barrels a day and that the oil go only to the six countries that have bought Iranian crude over the last six months—Japan, South Korea, China, India and Turkey, which bought cargos consistently, plus Taiwan, which bought a few scattered cargoes.

One qualification needs to be noted. The IEA figure for the most recent month, in this case December, is an estimate based on shippers’ information. The figures for the previous months are actual port counts of what has been unloaded and are much more accurate. The latest month estimate is often revised substantially by the IEA. For example, in its report last month, the IEA estimated November shipments by Iran at 0.85 million barrels a day. That has now been revised substantially to 1.10 million.

A point that is often overlooked is that Iran has clandestinely exported some oil this past year. It has shipped oil out in Iranian tankers that then met foreign tankers on the high seas that were partially filled with oil from another country. The Iranian oil was then offloaded onto those tankers, mixed with the foreign oil and delivered to buyers as oil from that other country.

The United States has caught at least two tanker firms engaged in those clandestine sales and put them out of business. But Washington has never published an estimate of how much oil Iran has managed to export over the known exports to the six approved buyers. So it isn’t known if those clandestine exports are significant financially.

It also is not known if Iran continues with such under-cover sales or if the United States has successfully stamped them out.

The world will be watching to see if any of the six approved countries now buy substantially more oil and try to break out of the US straightjacket and if any other countries buy Iranian oil—either clandestinely or above-board. If so, the issue is how hard the United States will come down on them. The US has threatened to shut the banks in countries that buy more Iranian oil out of the US financial system—capital punishment for any big bank.

That will be very difficult for Washington to do. But if it doesn’t do so, the whole edifice of oil sanctions will likely come crashing down.

In Tehran, however, many officials are publicly pretending the oil restrictions are now gone. For example, on January 20, the day the new interim nuclear deal took effect, Mohsen Qamsari, director of international affairs at the National Iranian Oil Co. (NIOC), told the Fars news agency that Iran can now raise its oil exports. Like other officials, he did not tell the public what the United States had said about maintaining a ceiling on Iranian oil exports.

One company being watched is Zhuhai Zhenrong Corp. of China. It was reportedly set up by China expressly to take oil from Iran in payment for arms that China supplied Iran during the 1980-88 Iran-Iraq war. The firm was sanctioned two years ago by the United States for selling Iran gasoline in violation of US sanctions.

A former Zhenrong executive told Reuters the company has no business in the United States and doesn’t care about US sanctions. But the Chinese government does care about the impact sanctions could have on Chinese banks and business in the United States and appears to have restrained Zhenrong throughout 2013.

India is also a major market for Iranian oil. Its state-owned refiners have had trouble getting insurance for their refineries because they processed Iranian oil. The insurance restriction has now been lifted by the interim agreement. But that doesn’t seem to have made any difference. A.S. Basu, managing director of Chennai Petroleum Corp., told Bloomberg news last week, “The benefit of the Iran deal is not percolating down. Our insurers are saying foreign re-insurers want to observe the situation for six months before extending any cover.”

The interim agreement is good for six months, so the re-insurers appear to be saying they don’t plan to act until they see whether there is a permanent agreement superceding the interim agreement.

In Tehran, much of the media is trying to make it sound as if sanctions are going away. PressTV, which is state broadcasting’s English outlet, ran a story proclaiming that South Korea had boosted its purchases in December right after the interim agreement was signed November 24. But South Korea only bought a total of 200,000 barrels more Iranian oil in December than in November. That is less than two hours of Iranian oil production and insignificant financially and statistically.

The real threat to US sanctions is a proposed Iran-Russia trade deal under which Russia would take 500,000 barrels a day of Iranian oil in a barter deal for all sorts of Russian-made goods. Reuters reported January 16 that such a deal was in the works. But nothing more has been heard since then. Neither country has denied the report. Some analysts think the negative reaction to the report from both the EU and US has scared the Russians off.