December 23, 2016

An Iranian-American millionaire living in Ohio has been indicted on charges he illegally took Food Stamps and Medicaid, programs designed to feed and provide health care for those in poverty.

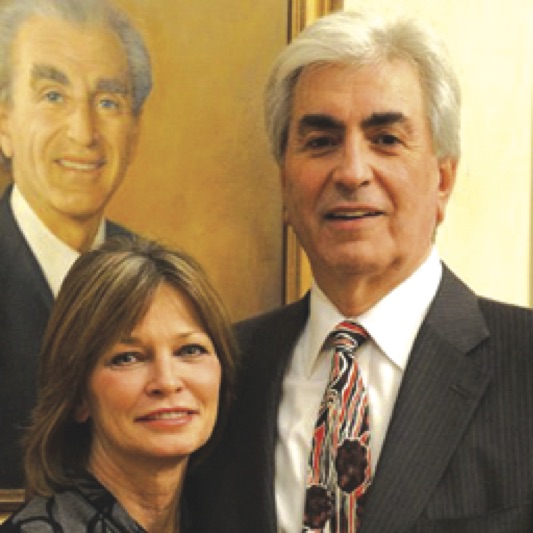

Ali Pascal Mahvi is facing four felony counts, which could put him behind bars for more than four years if convicted. Prosecutors say Mahvi defrauded Medicaid out of $45,000 and Food Stamps out of $8,400, while living in an 8,000-square-foot (740-square-meter) home outside Cleveland, Ohio, that sits on six acres (2.4 hectares) and has a stable with horses.

“I absolutely believe he should serve time behind bars,” said James Flaiz, the Geauga County prosecutor.

Mahvi told WKYC of Cleveland, “I’m not guilty.”

Mahvi, who says he is the son of a Qajar prince, estimates his worth at about $120 million. His $800,000 home features five bedrooms and five bathrooms and an in-ground swimming pool. Mahvi also says he owns 70 percent of a resort on St. Lucia, a Caribbean island.

But he insists he has operated within the law. He says he lives off loans from friends, which he argues are not considered income for food stamp eligibility.

Prosecutor Flaiz disagrees. “Through our investigation, we found they were actual investments and were not loans,” he said. “There were actually hundreds of thousands of dollars of what he was calling loans that we discovered he never declared.”

The allegations against Mahvi were first revealed in September, but it has taken time for the prosecutor to work his way through all the records and prepare the charges. (See September 16, 2016, issue of the Iran Times, page one.)

Mahvi says the criminal case shut down his efforts to sell airplanes to Iran. “I worked really hard to get Iran to buy Boeing and I lost that because of this, these allegations,” Mahvi told WKYC last week.

Mahvi denies having a $4 million Swiss bank account. He says that account had belonged to his father.

Flaiz says his staff is still combing through Mahvi’s 14 bank accounts. “Literally millions of dollars involved in what was going in and out of his accounts. That made this investigation difficult,” Flaiz said.

Mahvi says he and his lawyer will fight the charges starting next month when Mahvi is scheduled to appear in court for his arraignment.

In September, he said that despite his appearance of wealth, he was and is eligible for welfare. By law, he notes, his home, worth more than $800,000, and personal belongings, like the horses he owns, don’t preclude him from obtaining government assistance.

Mahvi said he’s relied on loans from friends to help his family survive.

“If you don’t like the [Food Stamp] system, change it,” said Mahvi, 65. “I can borrow a hundred million dollars from friends and still get Food Stamps.”

According to old news reports, Mahvi is the son of Abol-fath Mirza Mahvi, a Qajar prince and founder of M. Group Resorts, a resort development company.

The elder Mahvi is credited with developing the Jalousie Plantation Resort and The Jalousie Enclave on St. Lucia, an island state in the Caribbean packed with luxury resorts for the yachting class. The younger Mahvi acknowledges his wealth totals around $120 million. But he says that is locked up in the St. Lucia properties he inherited but cannot sell.

Mahvi says he’s broke. He has about $800 in the bank and is riddled with debt from failed business ventures and lawsuits filed by former investors.

He said, “All my adult life, I was an employer. I was paying people. And now, no one is taking care of me.”

On his Linked In page, Mahvi boasts, “I have flown aircraft since 16 and [was] an ocean sailor. I published my book, ‘Deadly Secrets of Iranian Princes – Audacity to Act,’ about my experiences in Iran and the Shah’s aspirations to be a nuclear power.”

Welfare officials said the Mahvis painted a picture of financial ruin and desperation. WKYC said the family told county workers they were surviving with the help of church donations and loans from friends. Records show the family received two personal loans—one in 2014 and another in February—totaling $25,400.

But according to the affidavit compiled by Geauga County investigators, the family has at least 14 bank accounts with a combined value of more than $4.2 million. Those funds were not disclosed when Mahvi applied for benefits, officials said.

Mahvi told WKYC the bank accounts are old and the Swiss account belonged to his father. He scoffed at the police contention that the Swiss account holds $4 million. “Show me the account. I will kiss your feet,” he said.

Detectives have combed through the bank accounts focusing on the 23 months—March 2014 to February 2016—when the Mahvis received food stamps.

They noted typical expenses for affluent families: a $4,600 monthly mortgage payment, $567 for cell phones, $200 meals at local restaurants and $350 for cable TV. And there were stops for tanning sessions and Starbucks. Mahvi did not deny the household expenses, but said his lifestyle is relative to others.

“It was our right to apply [for Food Stamps] and I applied,” he said.

Investigators say that while the Mahvis were receiving government assistance, their bank records show the family’s monthly net income ranged from at least $3,200 to more than $8,500. Mahvi said the money came as loans or donations from friends and cannot be counted as income under Food Stamp rules.

When Mahvi initially filed for Food Stamps in April 2014, he told the county that his total net income after taxes and housing costs was zero and that his resources—cash, savings and checking accounts—were less than $100, records show. In June 2014, the Mahvis filed an application for Medicaid.

Mahvi, however, wrote that in the next year he expected to earn more than $300,000 from his company, Idria Energy, and his Caribbean resort interest. A year later, in April 2015, the family re-applied for Medicaid and again, claimed zero income. The application was approved for one year.

His wife, Caryl, had income of $1,200 in rental fees and $1,700 in “other income.” That income, investigators said, was not disclosed when the family filed for Food Stamps.

During the investigation, detectives said they uncovered what appears to be bank transactions intended to keep actions below those that banks are required to report to the federal government. Banks must report any transaction in cash of $10,000 or more. On February 4, the family deposited $4,000 at 2:55 p.m. About two minutes later, $6,000 was deposited. Similar dual transactions were made in April and May, each minutes apart.