October 04-2013

Iran handed Syria a $3.6 billion credit for buying oil products over the summer. The loan will be repaid by giving Iran equity stakes in investments in Syria—stakes that would likely be worthless if President Bashar al-Assad doesn’t win the civil war.

Tehran has already provided military assistance to Assad—arms, training, intelligence aid and strategic advice.

The new loan, which was announced by the Syrian state news agency, gives Iran a growing economic interest in seeing the Syrian fighting through to victory.

Syria is short of diesel for its army and fuel to keep the economy running, partly because of US and EU financial sanctions imposed on Syria after the crackdown on protests at the start of the crisis two years ago. Syria’s main supplier of petroleum products by sea has long been Iran.

With Iran now selling only 45 percent as much oil as it sold before oil sanctions took hold one year ago, Iran has lots of crude oil sitting around and can probably refine most of what Syria needs without difficulty. The deal is most likely more significant in foreign policy terms than it is in economic terms.

Still, it cannot be overlooked that Iran has a growing economic investment in Syria that will likely turn to dust if Assad goes.

A $1 billion credit line to Damascus was extended earlier to buy Iranian power generating products and other goods in a barter arrangement that has helped Syria export textiles, phosphates and some agricultural products such as olive oil and citrus fruits, trade officials said.

Alongside the favorable deferred payment terms of these two financing facilities, Damascus has been in talks for months to secure a loan of up to $2 billion with low interest and a long grace period, one official told Reuters.

The country had been earning some $2.5 billion a year from oil exports before the crisis. With the economy now on a war footing and military costs spiraling, Syria has been forced to rely increasingly on new credit lines from its main allies. Russia, Iraq and China have provided support—sometimes in the form of barter deals—but not on the scale of last week’s credit line.

The latest deal should also ease financial demands on an economy whose $60 billion GDP is estimated to have shrunk by around 30 percent since the conflict began two years ago.

Bankers told Reuters the credit facilities would be channeled through the state-owned Commercial Bank of Syria and Iran’s Bank Saderat.

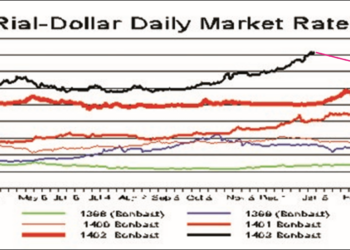

The pound has crashed as low as one-sixth of its pre-crisis value against the dollar, leading to rampant inflation. “There will be less demand on the dollar when the state gets oil products and flour from Iran and we export to them textiles and some foodstuffs,” said Essam Zamrick, deputy head of the Damascus chamber of industry.

Last year Iran and Syria arranged a gasoline-for-diesel swap, but the loss of Syria’s main oil producing areas in the east to the rebels meant Damascus no longer has the light crude it produced nor the extra gasoline and naphtha it used to export to Iran.

Iranian firms have also been awarded more contracts in the power sector and have signed deals to construct several grain silos, which will be financed through the expanded credit lines, one banking source said.

Under that credit financing deal, Syria has also received 250,000 tons of Iranian flour, easing bread shortages in government-held areas caused by the loss to rebels of almost half the northern city of Aleppo, where most of the country’s milling capacity is sited.