September 20-2013

Iran is boosting exports of iron to China and India in an effort to replace part of the massive revenue lost due to sanctions on its oil sales.

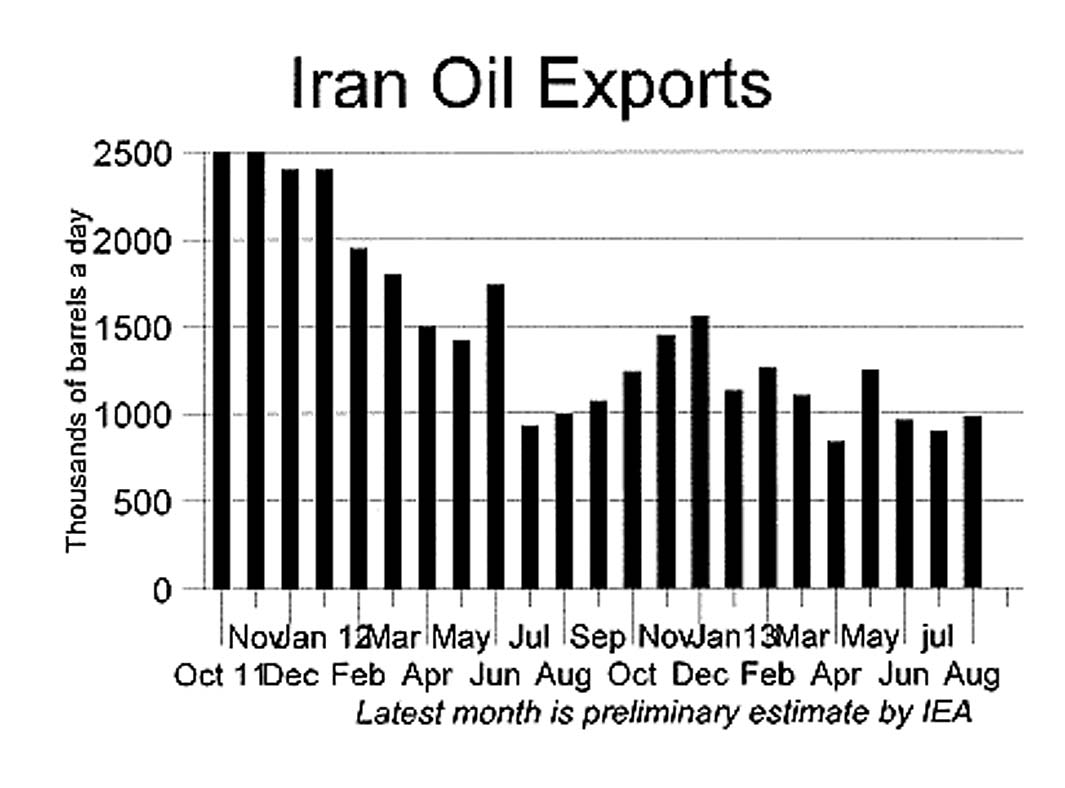

While Iran’s oil exports are down 55 percent due to sanctions, iron ore exports have grown by more than 60 percent over the same period to an annual rate of about 25 million tons, worth about $3 billion a year at current prices.

The extra billion dollars a year that Iran is gaining from the additional iron exports, however, is still a pittance when compared with the loss in oil revenue of roughly $35 billion a year.

“Sanctions have forced Iran to look at other ways of earning export revenues besides oil and gas, and the mineral sector has been doing pretty well. I know there has been quite a substantial increase in things like iron ore exports,” Mehdi Varzi, a former official at the state-run National Iranian Oil Co, who now runs an energy consultancy firm in the UK, told Reuters.

“We’re selling more iron to India and China,” said an Iranian industry source on condition of anonymity. “No money is coming directly to Iran because of the issues with currency [meaning US banking restrictions], so in some cases there are some barter deals, otherwise cargoes are paid mostly with cash.”

Mines are “being opened every week” in Iran as businessmen there see it as a profitable business and one of the few sectors not sanctioned yet, said the source.

While China primarily buys raw iron ore, the Islamic Republic is also boosting exports to India of sponge iron. Ironically, India is the world’s top producer of sponge iron, but producers there are grappling with high production costs and suffering from the more aggressive Iranian exporters.

Like iron ore, sponge iron does not come directly under Western sanctions as of yet.