May 17, 2019

Hardly any oil has left Iran’s ports this month. The future looks grim for the country’s oil exports, though it will take another several weeks to know just how bad things are for the Islamic Republic.

Hardly any oil has left Iran’s ports this month. The future looks grim for the country’s oil exports, though it will take another several weeks to know just how bad things are for the Islamic Republic.

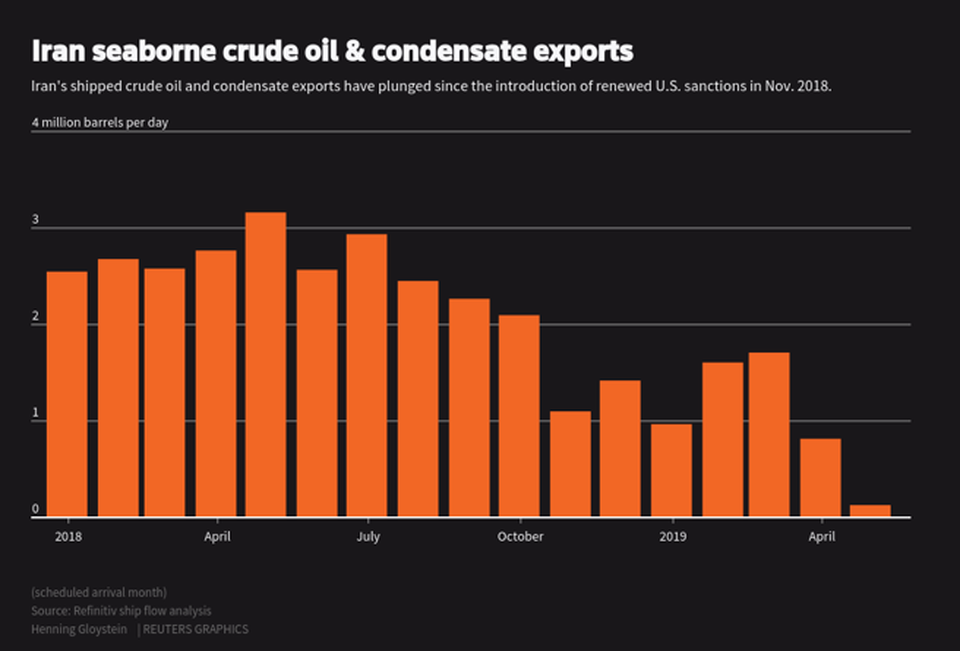

Data from Refinitive Eikon, a firm that monitors tanker movements, said that as of May 17 Iran’s oil shipments in May came to a mere 250,000 barrels per day, just 10 percent of normal pre-sanctions exports of 2.5 million barrels a day.

Under sanctions, exports have averaged 1.1 to 1.2 million barrels a day in recent months, as they did in 2012-15, when the EU and US imposed stiff sanctions prior to the nuclear agreement.

The huge drop in May came as President Trump surprised the world April 22 by killing the waivers he had given several countries to allow them to buy limited amounts of Iranian oil. The huge drop in May is the result of the Trump decision. But that doesn’t mean no one will buy oil in June. It just means everyone is waiting and watching. Yet, clearly no company wants to be the first to defy the United States—and the first to suffer consequences.

Iran’s normal exports have totaled 2.5 million barrels a day since the early 1990s, except for the period from mid-2012 though the end of 2015, when the joint US and EU sanctions cut sales to around 1.1 million to 1.2 million barrels a day. Prices were above $100 a barrel during most of that time, which relieved the pain for Iran.

At the start of November, President Trump re-imposed the US sanctions, but issued waivers that allowed Iran’s traditional buyers to continue buying large volumes of Iranian oil. Iran’s oil exports since then again averaged 1.1 million to 1.2 million barrels a day. But prices have largely been below $70 a barrel, so the pinch has been more painful this time.

Trump killed the waivers as of May 2 and his aides said the goal was to drive Iran’s exports to zero. Here is where things stand as of mid-May with regard to the five countries that kept buying in the 2012-2015 period and that have kept buying the last six months.

China: China is by far the largest buyer of Iranian oil, taking about half of all Iran’s exports so far this year. The government of China has criticized the US re-imposition of sanctions, but only tepidly. And now, three sources tell Reuters, China’s two big crude importers, Sinopec and China National Petroleum Corp. (CNPC), will not be buying any Iranian crude in May. They haven’t said what they will do in June.

India: India is Iran’s second biggest customer. It has ordered no Iranian oil for May delivery and Foreign Ministry spokesman Raveesh Kumar told a news conference May 2 that India is seeking supplies from other countries to replace Iranian oil.

(Note, according to Business Energy, at least 120,000 barrels a day in deliveries to China and 100,000 barrels a day of deliveries to India are debt repayments, so those volumes could continue, but Iran would not be receiving any revenues from them.)

Turkey: Turkey has been the most vocal oil buyer in denouncing Trump’s refusal to renew waivers. Turkish Foreign Minister Mevlut Cavusoglu announced May 2 that Turkey cannot replace Iranian oil with other oil quickly because its refineries are not set up to accept other types of crude. But a few days later, TUPRAS, the country’s largest refinery and main buyer of Iranian oil, said it had ended all purchases of Iranian oil. It said it is looking at Russia, Iraq and Saudi Arabia as replacement sources. It did not say that this decision to buy elsewhere was permanent. But it will buy not a drop of Iranian oil in May. And once it has invested to adapt to other sources of crude, one might ask why it would bother to shift back again.

South Korea: South Korea was allowed to buy 200,000 barrels a day from Iran, but it has bought only a bit more than half that amount since November. It has ordered no deliveries for May. South Korea buys mainly condensate from Iran rather than crude oil. It has been looking for alternatives ever since last year, but news reports from Korea say it prefers Iranian condensate both for quality and price.

Japan: Japan started reducing its buys of Iranian oil in November and last bought a cargo of Iranian oil in March.

Syria: Iran has long made periodic deliveries of crude to Syria. It stopped in December, resulting in long lines at Syrian service stations. In the first week of May, an Iranian tanker unloaded 1 million barrels of crude in Syria, according to TankerTrackers. But these deliveries are all on credit, as Syria has no money, and Iran is getting no current revenue for these deliveries.

The US also gave waivers to Italy, Greece and Taiwan to allow then to buy Iranian oil after November 2. But they never bought any Iranian oil.

The Iranian media have avoided reporting the May sales news to the Iranian public. The media have recently carried numerous stories about countries buying Iranian oil in April, while international news agencies have reported the absence of loadings in May.

President Rohani has joined the rhetorical assault on the United States. He said the effort to push Iranian oil exports to zero would fail and the people of Iran would instead “bring America to its knees.”

And Supreme Leader Ali Khamenehi also joined in. “America’s efforts in sanctioning the sale of Iranian oil won’t get anywhere,” he said. “We can export as much of our oil as we need and want.”

The government has also pushed reports to try to alleviate any public fears. For example, Hadi Haqshenas, deputy director of the Ports and Maritime Organization, said, “The Oil Ministry’s tactics in exporting oil and petroleum products have changed,… and perhaps the destinations of oil cargoes from our ports have changed.” But he didn’t explain how that would make any difference if very few tankers are loading any oil in Iran.

Iran has indeed made some changes. On May 2, Masud Karbasian, head of the National Iranian Oil Co. (NIOC), announced that foreign companies selling goods to Iran, who can’t get paid because of banking restrictions, could take crude oil in payment instead—in other words, a barter arrangement. But companies that don’t deal in oil are rarely interested in being saddled with selling oil or any other product whose market they don’t know. Some analysts said Iran would have to deliver crude at an immense discount to make that barter offer of interest to foreign firms.

Some in Iran are saying that Washington will be foiled because the price of oil will surge above $100 a barrel so that Iran’s oil income will jump. As the chart on Page Six shows, the price of an OPEC barrel did rise after the US announced the end to waivers. But then it fell. The day that Washington announced it was ending waivers, an OPEC barrel sold for $72.44. As of May 16, the price was $72.61 or a mere 17 cents higher.

The US State Department said the decision to end waivers was made when US government analysts concluded there was enough oil supply to met demand without any Iranian oil.

Saudi Arabia, meanwhile, announced May 8 that it will fulfill all the requests it has received for oil to be delivered in June.

Iranian Oil Minister Bijan Namdar-Zanganeh called Washington’s goal of lowering Iran’s oil exports to zero nothing but a “pious hope.” He also insisted that Saudi Arabia and the UAE do not have enough unused capacity to make up the loss of Iran’s oil. No one agrees with that. Saudi Arabia and the UAE have at least twice as much spare capacity as Iran’s exports. The US is also ramping up crude exports.

Before the waivers were dropped, the US Energy Information Agency, part of the US Energy Department, projected that US oil production during 2019 would rise by 1.5 million barrels a day. That rise alone far exceeds Iran’s current oil exports.

However, it must be remembered that Venezuelan oil exports are falling because of US sanctions and Venezuela’s loss of skilled staff, who are fleeing the country. Also, production from Nigeria and Libya is erratic and jumps about because of disorder.

Total world production is currently 101.5 million barrels a day. So, if the US does drive Iranian oil exports to zero, the loss of the additional 1.1 million to 1.2 million barrels a day will amount to barely 1 percent of the world market.