December 1, 2023

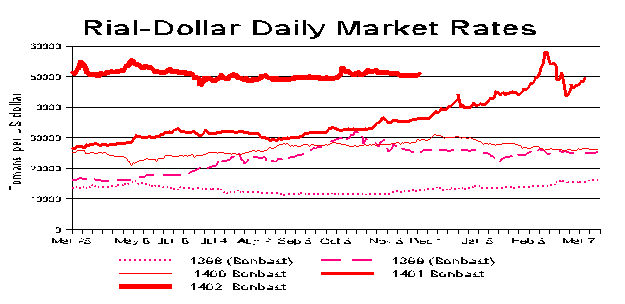

In recent months, the rial has remained remarkably stable if virtually worthless. It’s difficult to remember that just a year ago, it had just passed 300,000.

But there are fears the rial could soon plunge passed 600,000 to the dollar. The Central Bank is clearly fearful of that and has now taken some measures to try to keep the currency from again plummeting.

It has initiated a foreign currency rationing system for trade and industry. The decision took many economic stakeholders by surprise and has sparked concerns as the allocated foreign currency does not appear to meet the needs of these sectors, the daily business newspaper Donya-e Eqtesad reported October 16.

Head of the Tehran Chamber of Commerce Mahmud Najafi-Arab described this sudden policy shift as another example of unilateral changes imposed by policymakers.

Adding to the unease, Najafi-Arab said, is that this currency rationing comes at a time when traders are the primary suppliers of capital.

This foreign currency rationing scheme is the latest measure employed by the Central Bank of Iran to regulate the foreign exchange market. The bank has already outlawed any foreign currency trading outside the exclusive channels it has established. Moreover, traders have long been mandated to sell their export earnings to the Central Bank at prices lower than free market rates.

The timing of the new measure is significant, coming soon after the outbreak of the Israel-Hamas conflict, which had a ripple effect on the market, particularly affecting exchange rates of major foreign currencies against the Iranian rial.

The Iranian government’s motivation behind the rationing measure seems to be to ration the dwindling foreign currency reserves in the country amid lingering sanctions against Tehran while mitigating the psychological impact of regional conflicts on exchange rates.