October 14, 2016

Iranian oil output appears stagnant, increasing only marginally in the last five months despite perpetual talk from Iranian officials about pumping production up beyond 4.0 million barrels a day.

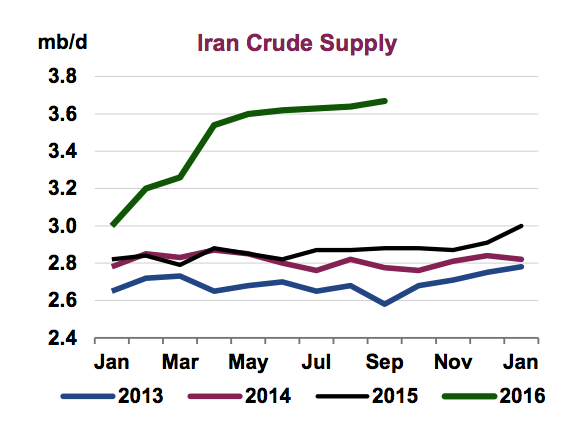

The Paris-based International Energy Agency (IEA) said Tuesday that Iran’s crude oil output reached 3.67 million barrels a day in September. But production hit 3.6 million in May, so the rise over the summer has been inconsequential.

Production is now back where it was in 2011, before harsh sanctions were imposed in July 2012.

While Iran likes to talk about boosting output passed 4.0 million, the fact is that Iran has been unable to produce at that level for a decade. Iran’s aging fields went into decline around 2006 with output falling little-by-little almost every month in succeeding years. In the industry, it is widely believed that Iran requires foreign investment and expertise to develop new fields and use modern technology to squeeze more oil out of aging fields.

The accompanying chart at left shows how quickly Iranian production recovered after sanctions were lifted in January. By April, after only four months, Iran had boosted crude output from about 2.9 million barrels a day to almost 3.6 million, the pre-sanctions output level.

The other chart shows Iranian exports of crude oil, which are continuing to rise. Exports jumped in April and have continued to rise every month since then, according to the IEA. The main reasons for the increase has been Europe’s return to buying Iranian crude and higher buys by India. This chart shows only crude oil exports, which were at 2.3 million barrels a day in September, according to the IEA. Adding in exports of condensate, Iranian exports easily now top 2.5 million barrels a day, which was the average of Iranian exports in the two decades before harsh sanctions.

The Iranian oil industry is fully recovered and back where it used to be after 3 1/2 years of sanctions-induced depression from mid-2012 to the end of 2015.

Looking at OPEC as a whole, the group pumped a record volume in September—even as it announced it had agreed to cut output! OPEC output hit 33.64 million barrels a day. The group pledged that it would cut output to somewhere between 32.5 million and 33.0 million in December. But the real issue lies with Iran, Libya and Nigeria, which were exempted from the announced cuts, and Iraq, which says it plans to produce more regardless of what OPEC says.

Iran, however, looks unlikely to boost output substantially in the coming months. Any big boost will likely require foreign investment and that won’t produce a major output hike for a few years.

In Libya, years of fighting that blocked oil export terminals ended recently when a militia took control of key export facilities and agreed to resume shipments. The official government of Libya also plans to link long-dormant oilfields to a new export pipeline. Libya says its production could more than double to 700,000 barrels a day.

Nigeria, where oil thieves and rebel bands have sabotaged oil facilities, is now adding 200,000 barrels a day to its exports after repairing a pipeline that had been out of commission for months.

Iraq says its output is rising and will continue to rise. The IEA said Iraq’s production rose 90,000 barrels a day in September compared to the previous month.

It wouldn’t be a surprise if those four countries added 750,000 barrels a day to supply while the other OPEC members are pledged to cut output by a 500,000 to 1,000,000. In other words, a major cut in total OPEC output does not look likely.

Saudi Arabia, which led the initiative that last month promised production cuts, reduced its output by 20,000 barrels a day last month, the IEA said. Saudi Arabia is expected to cut production by about 400,000 barrels a day automatically as falling temperatures reduce the need for air conditioning across the kingdom.

The chart on on the right shows that the price of an OPEC barrel jumped 15 percent in the seven days after OPEC announced production cuts. But the price of an OPEC barrel is still under $50—it was $48.31 on Monday—and the market may be softening as it sinks in that the promised cuts may be ephemeral.