October 05, 2018

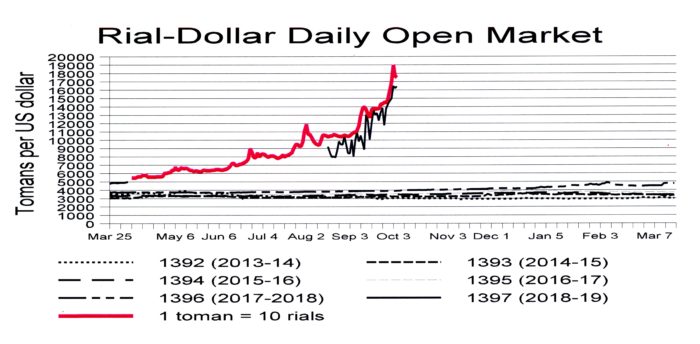

The rial recovered slightly in the following week and was selling for around 170,000 to the dollar as of October 1. That emphasizes—as the chart makes eminently clear—that the rial is stunningly erratic, jumping and dropping on successive days with no seeming rhyme or reason.

However, on October 2, the market went into a crazy turmoil, with some sales of the dollar for just 135,000 rials being reported. This seeming rally came after Tehran Police Chief Hossain Rahimi told state television, “Managers of more than 15 websites that were announcing prices and caused irregularity in the economic situation were summoned or detained.”

The Sanarate website, which reports sales on the open market, that is, through the currency exchange shops found all across Tehran, went dark. It was not reachable either October 1 or 2, at which point the Iran Times went to press.

The Iran Times daily checks four other websites that report the prices of foreign exchange on the black market. On October 2, one of those sites, Mesghal, listed the US dollar at 42,000 rials, the official subsidized rate used by the government for imports of such things as food and pharmaceuticals. 2gheroon simply deleted the US dollar, although carrying prices for dozens of other currencies. The other two sites, bonbast and bazar360, both listed the dollar at an even 150,000 rials.

The government has continued intervening in the market and making new rules and changes every few days in an effort to stop the collapse—but, as the accompanying chart shows, things generally keep getting worse.

The Tehran Chamber of Commerce has complained that part of the problem is the government’s constant tinkering with the rules.

On September 29, the government touted what it billed as a major change in the rules, saying the Central Bank’s governor has now been given “the necessary authority to intervene in the foreign exchange market and to manage it.” But the last thing the business community wants is for the government to stick its fingers into things and manage them even more than now.

The new, though unexplained, rules were issued by the High Economic Council, which was set up recently and is comprised of the heads of the three branches of government—President Rohani, Majlis Speaker Ali Larijani and his brother, the chairman of the Judiciary, Sadeq Larijani—not exactly a triumvirate respected for its mastery of the economic sciences.

The announcement from the government sounded like the government plans to dictate the foreign exchange rates, something that almost everyone views as insane.

The announcement said: “The Central Bank will intervene in the foreign exchange market through banks and authorized exchange shops and carry out the necessary measures to control the exchange rate of hard currencies.” It said the Central Bank “will announce the rate of exchange in the foreign exchange market at an appropriate time.”

Although sanctions are often blamed for the rial’s slide, market analysts generally say the problem is more complex than that. They generally see the slide due, in the short run, to the fact that too few dollars are available in the market to meet the demand for dollars. The law of supply and demand applies and the dollar gains value. In the long run, many analysts say, the big problem is that the regime just keeps printing money, devaluing the rial with every press run.

Central Bank Governor Abdolnasser Hemmati said September 1 that Iran’s money supply had nearly tripled since President Rohani took office in August 2013. That would be fine if the economy had tripled in size during that time. But it hasn’t.

There are likely other problems as well. The Financial Tribune notes that Iran is selling most of its oil to China, India, Turkey and South Korea. It is selling the oil for those countries’ own currencies—and those currencies have been losing value against the dollar this year.

As for the new rules now being imposed on the foreign exchange market, Mahmud Vaezi, Rohani’s chief of staff, told state television that the new policies “will definitely halt the fall of the rial within the next two months,” that is, by December 1. Similar promises have been made before.

Teymour Rahmani, a professional economist, told the Financial Tribune that the immediate problem was that Nima, the secondary market where exporters are supposed to sell their hard currency earnings to importers, just isn’t working. Like many others before him, he says the exporters are not sending their foreign currency revenues to Nima as they have been ordered to.

Another economist, Kamran Nadri told the newspaper that there is “little if any incentive for exporters to sell their hard currency on Nima.”

He said he had seen the list of new powers supposedly being given to the Central Bank governor. But he said they are not new powers; they are powers that were stripped from the bank in past months and are now to be restored.