December 31, 2021

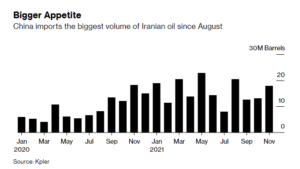

China increased it clandestine imports of Iranian oil in November, but is still not buying all that much, according to the market intelligence firm Kpler.

Traders told Bloomberg News that Iranian cargoes have been sold to China at a discount of at least $4 a barrel off the ICE Brent price, about a 6 percent discount.

China’s official figures show it has not bought any Iranian oil since December 2020. That is done to appease the Americans by trying to show that China is abiding by US sanctions. The Iranian oil that China is buying has largely been re-branded and marketed as oil from Malaysia or Oman.

Meanwhile, Raisi Administration officials appeared confused over how to convey Iranian oil policy to the public.

On November 27, Mohsen Khojasteh-Mehr, the CEO of the National Iranian Oil Co. (NIOC), told reporters the company planned to boost production capacity to 4 million barrels a day by Now Ruz. Current output is about 2.5 million.

Khojasteh-Mehr said the NIOC had already secured the funds needed to boost production capacity.

Three weeks later, however, Oil Minister Javad Oji said output from “many” oil wells had plummeted to just a token 1,000 barrels a day due to lack of maintenance. He said the company needed $160 billion in investments just to avoid becoming a net importer of oil and gas in a few years.

He said natural gas consumption is rising by 10-12 percent annually and the company cannot keep up with the demand. Natural pressure is falling in many wells and Iran needs new technology to prevent a fall in gas production, he said.