July 22, 2016

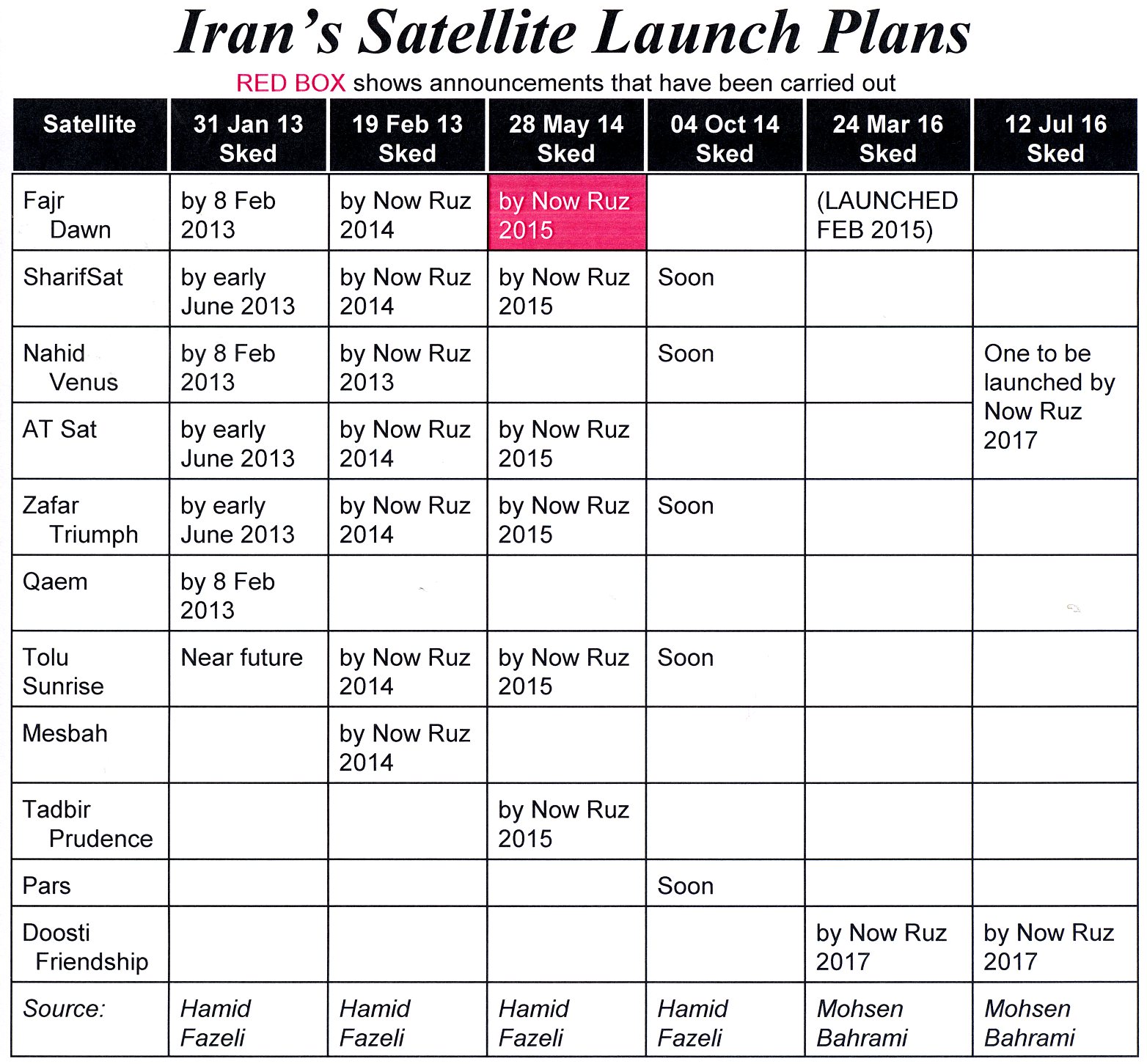

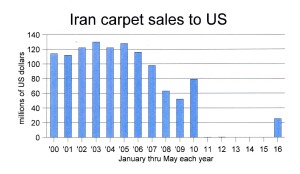

With the easing of sanctions, the Islamic Republic has resumed carpet sales to the United States, but has not gotten back anything like the market it once had. Sales are running at less than a quarter the levels of a decade ago.

With the easing of sanctions, the Islamic Republic has resumed carpet sales to the United States, but has not gotten back anything like the market it once had. Sales are running at less than a quarter the levels of a decade ago.

This is worrying news for the economy since the carpet industry is a huge employer.

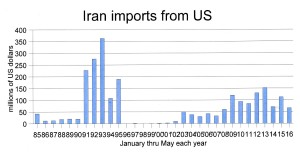

On the other side of the trade issue, Iran has actually reduced the volume of its purchases from the United States so far this year.

On the other side of the trade issue, Iran has actually reduced the volume of its purchases from the United States so far this year.

US statistics on trade from January through May show that Iran sold the United States $27.6 million worth of goods in that five-month period. Of that, 92 percent comprised carpet sales. Iran is only allowed to sell to the United States textiles and foodstuffs. Historically, that has meant carpets, caviar and pistachios. But now, it effectively means carpets only.

With the near exhaustion of sturgeon in the Caspian Sea, Iranian caviar production has dropped from hundreds of tons a year to a handful of tons. As for pistachios, the United States imposes a punitive tariff of 318 percent on the Iranian nut, which essentially shuts them out of the United States.

As the accompanying chart on carpet sales shows, the post-sanctions sales are running far below the sales levels of the first half-dozen years of this century. Sales then were consistently in excess of $100 million for the January-May period each year. Sales for that period this year were only $25.4 million.

But as the chart also shows, Persian carpet sales to Americans fell drastically in 2007, 2008 and 2009, which is assumed to reflect the market being captured by Indian, Pakistani and Chinese carpets with Persian designs being offered more cheaply.

Sales jumped in January-May 2010. That reflected bulk orders by American merchants stocking up before a ban on Persian carpet imports took effect in mid-2010. That ban was lifted this past January.

The question now is what level of sales Persian carpets will get back to in the United States. Many think Pakistani, Indian and Chinese weavers have permanently seized much of the market Iran once enjoyed in the United States.

This is economically a very important question for Iran. While crude oil has always generated far more revenue than carpet sales, the carpet industry employs far more people than the oil industry and is crucial in the battle against joblessness.

The other chart shows the total of Iranian imports of American goods in the January-May period for every year back almost to the revolution. Iranian purchases were heavily restricted in the 1980s and then almost completely banned starting in mid-1995 by President Clinton. In 1999, Clinton modified the ban to allow Iran to buy such items as medical gear, pharmaceuticals and agricultural goods. The only change as a result of the nuclear deal was that the ban on sales of civilian aircraft and aircraft parts was lifted.

Since January, Iran has only bought $22,000 worth of aircraft equipment. Its purchases of US products have been 67 percent agricultural goods—half—of which was soybeans—and 26 percent medical-related items.

But Iran’s total of imports from the US in January-May this was less than half the level of last year in that same period. In fact, Iran bought less this year in January-May than in any year since 2008. There is certainly no surge in any interest in buying more American goods.

But that isn’t surprising. Iran’s imports of American products have been erratic in this century because Iran seems to see the United States as the supplier of basic grains of last report. When needed, it makes a sudden, one-time, huge buy of maize or soybeans or some other grain. That drives the total sales figure.

Many American-made consumer goods are found in Tehran shops, where they tend to sell for a premium price. These items do not show up in the US export figures because they are bought by Iranian merchants from middlemen, mostly based in the UAE, and show up as US exports to the UAE.