November 18, 2016

The government is severely cutting back work on development projects as its revenue fell short of forecasts by a quarter in the first half of the Persian year.

Low crude prices were part of the problem, but taxes also did not produce anywhere near what had been predicted.

Current state revenues can barely cover operational expenditures forcing the government to severely cut back its construction projects to cope with the deficit, a Central Bank report on the state of Iran’s finances released last Thursday showed.

In the annual budget for the current Iranian year (started March 20), the government expected to take in 802 trillion rials (about $22 billion at the free market exchange rate) in the first half of the year. However, the administration actually took in just 589 trillion rials ($16.4 billion)—27 percent less than the target.

Many analysts foresaw this when the budget was being drafted with optimistic forecasts.

TheFinancial Tribune said the government’s fast growing deficit is, however, mainly due “to its bulging expenses and not just its low revenues.”

The Rohani Administration has banked heavily on a flood of foreign investment and a surge in crude oil revenues to boost a shrinking economy. “Both hopes were dashed,” the”Financial Tribune said bluntly.

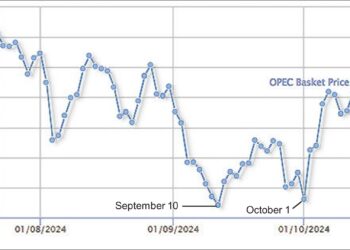

Investment has come in at a slower rate than anticipated. Petroleum revenues also disappointed, as low crude oil prices curbed gains from surging exports.

The administration made 245 trillion rials ($6.8 billion) from petroleum exports—172 trillion rials ($4.8 billion) from crude oil and 52 trillion rials ($1.4 billion) from gas condensates and petroleum products—in the first half of the year. That is 35 percent less than the government’s 379 trillion-rial ($10.5 billion) target for the first half of last year.

Public officials have regularly boasted that Iran is no longer dependent on oil revenues and that taxes provide more state revenues than oil sales. But that is because oil prices are so depressed.

The administration made 433 trillion rials ($12 billion) from direct and indirect taxation in the first half of the year, 30 percent more than the same period a year before—but 18 percent less than the government’s target, the Financial Tribune reported.