December 25, 2015

The Islamic Republic plans to issue “at least” $500 million in bonds denominated in foreign currencies next year after sanctions are lifted.

In the 36 years since the Islamic revolution, the country has dipped into international debt markets exactly twice, both times in 2002. Those bonds, worth a total of 1 billion euros, matured almost a decade ago and have long since disappeared from markets.

Deputy Economy Minister Mohammad Khazaee announced the planned sale in an interview last week with The Wall Street Journal.

Khazaee said the sale was intended as a test of foreign interest in investing in Iranian debt after the end of the nuclear hassle. “We have to test the market outside Iran,” he said.

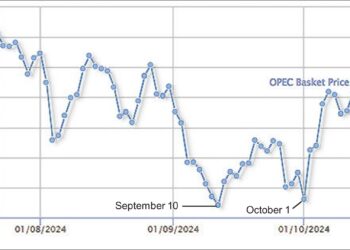

Another reason is low oil prices. The plunging oil market has spurred other oil producers like Qatar and Saudi Arabia to issue bonds lately.

One problem for Iran is suspicions as to whether it will adhere to the nuclear agreement. If it doesn’t, sanctions could be “snapped back” and investors would be squeezed.

On the other hand, many economists think Iran has lots of room for growth after being squeezed for so long by sanctions. Furthermore, it has so little debt that it has lots of spare capacity for bond issues. Iran’s total government debt was just 11.4 percent of gross domestic product last year, according to the CIA’s World Factbook. That’s lower than 91 percent of the countries tracked by the CIA.

It compares with 100.5 percent for the United States.

And Iran has never defaulted on a bond issue.

Khazaee didn’t say in what currency the bonds would be denominated. He gave the total in US dollars, but the bonds are more likely to be issued in euros since no US residents—non-citizens as well as US citizens—are allowed to buy Iranian bonds.

Iran announced in September that it planned to sell bonds worth $1.7 billion denominated partly in rials and partly in euros to be sold in domestic and foreign banks. The resulting funds are to be used to boost oil production capacity by about 300,000 barrels per day and daily gas production capacity by 48.6 million cubic meters.

But the big question is how the bonds will sell.

In December 2012, the Central Bank acknowledged that its last sale of rial bonds had flopped.

The Tehran Times quoted Ali-Asghar Mir-Mohammad Sadeqi, then deputy governor of the Central Bank, as saying that in the Persian year that ended in March 2012, the Central Bank issued $7.5 billion worth of rial bonds but actually sold only $3.8 billion or 51 percent.

In an interview last summer with Bloomberg News, Hans Humes, founder of the New York-based hedge fund Greylock Capital Management, said of Iranian eurobonds, “The bond market appetite for everything Iranian will be pretty high.”

The US increased interest rates this month for the first time in years, and that will likely erode demand for developing-nation debt in general. Iran will probably want to raise money as soon as possible to lock in borrowing costs below 10 percent, said Amir Zada, a managing director at Exotix Ltd., which specializes in illiquid and distressed emerging-market debt.

The bulk of Iran’s outstanding debt—about $6.5 billion—is from bilateral loans it received from Asian countries, according to Dina Ennab, an analyst at Capital Intelligence. Zada, who used to trade Iranian debt while working in Exotix’s London office, said he expects there will be investor demand “from all over the world” when the country issues its bonds.

“Fiscally, Iran is very prudent and in good stead,” said Zada. “They currently have no external debt. I’m sure once sanctions are lifted, there would be substantial demand for their hard currency debt.”